Revolutionize B2B Payments with Sage AR Automation

Table of Contents

- The current state of B2B payments: challenges and opportunities

- Cost and labor savings through integration with Sage financial systems

- The Paystand-Sage Integration advantage

- Unlocking Sage Intacct’s automation benefits

- The future of AR with Paystand and Sage Intacct

Key Takeaways

- Legacy B2B payment systems create inefficiencies, including high transaction fees, manual processes, and cash flow delays.

- The Paystand-Sage integration offers a modern solution that leverages blockchain, automation, and cloud technology.

- By automating accounts receivable workflows, the integration reduces labor costs, eliminates credit card fees, and accelerates cash flow.

- Businesses benefit from instant payment reconciliation, advanced security measures, and seamless integration with Sage Intacct.

- Features like payment links, virtual terminals, autopay, and branded portals streamline collections and improve DSO.

- The Paystand-Sage solution helps businesses save over 50% on receivables costs while enabling scalability and operational efficiency.

- Companies adopting Paystand and Sage Intacct can modernize their financial processes and enhance profitability in a competitive landscape.

CEOs struggle to identify top-tier technology to streamline operations in today's business landscape. Timely payments are crucial for successful business management. However, high fees and old systems can complicate modern payment and accounting processes.

Paystand and Sage have partnered to create a revolutionary "Venmo-for-business" solution. This integration makes B2B payments easy and efficient directly from your ERP system by leveraging blockchain and cloud technology.

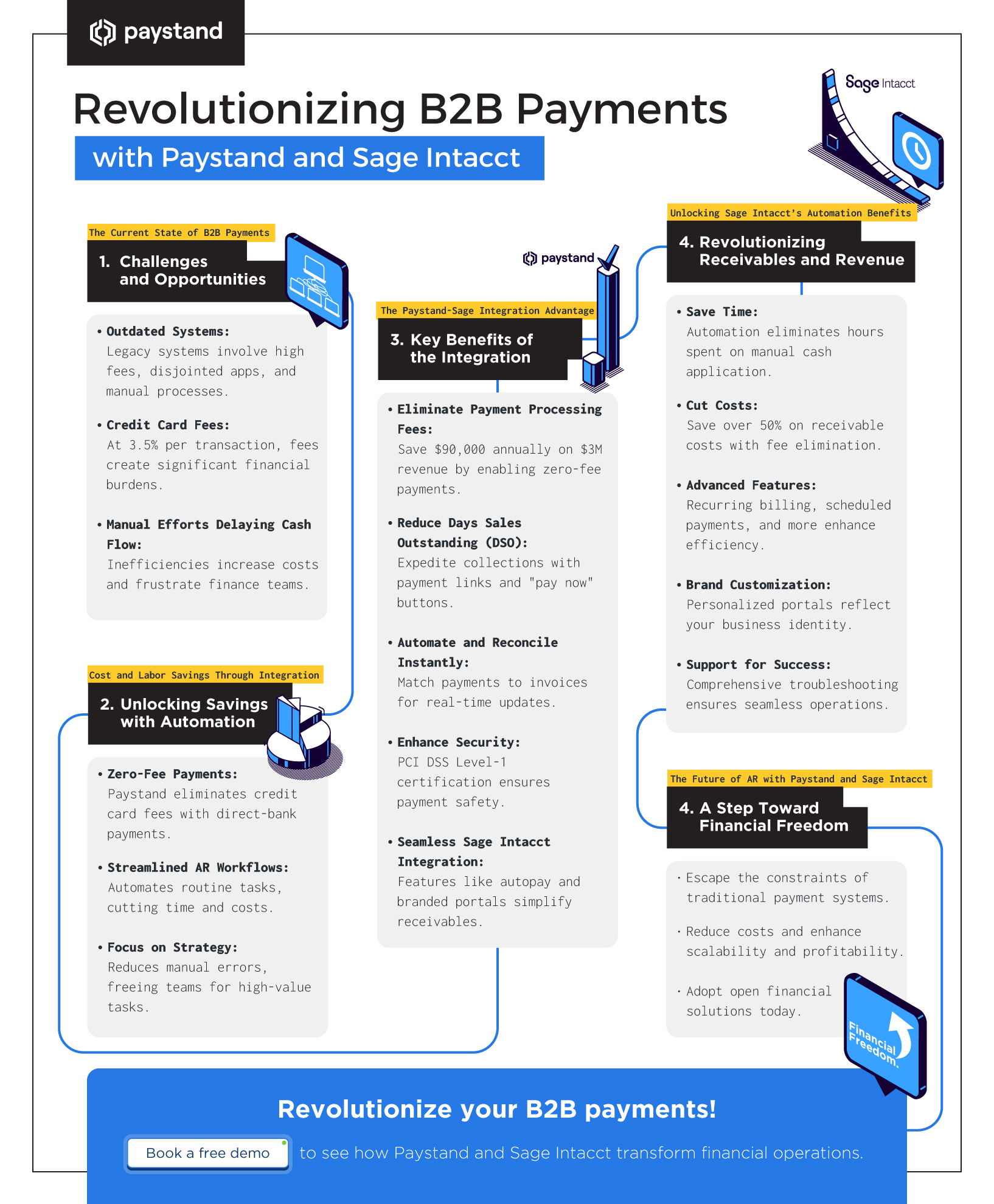

The Current State of B2B Payments: Challenges and Opportunities

Despite advancements in consumer payment automation, B2B payments remain tethered to outdated systems that hinder efficiency and growth. These legacy systems often involve high fees, disjointed applications, numerous spreadsheets, and cumbersome manual processes. Before the Internet, AR departments struggled with expensive, time-consuming payment systems; many of these inefficiencies persist today. Credit card fees, reaching up to 3.5% per transaction, represent a significant financial burden. In addition to fees, the lack of streamlined, automated processes can delay cash flow, increase administrative costs, and create frustration for finance teams.

However, these challenges present opportunities for businesses to adopt modern solutions. Innovations like the Paystand-Sage integration leverage automation, blockchain, and cloud technology to eliminate inefficiencies and reduce costs, paving the way for more agile and scalable financial operations.

Cost and Labor Savings Through Integration with Sage Financial Systems

Integrating Paystand with Sage financial systems delivers transformative cost and labor savings. Businesses often face rising costs due to high transaction fees and inefficiencies in payment processing. These challenges are compounded by the manual reconciliation processes that consume time and resources in AR departments.

The Paystand-Sage integration addresses these issues by streamlining accounts receivable workflows, automating routine tasks, and reducing dependency on costly payment methods like credit cards. Businesses can significantly cut transaction costs by enabling zero-fee, direct-bank payments while improving cash flow management. Moreover, automation minimizes human error and accelerates financial processes, allowing finance teams to focus on higher-value tasks such as strategic planning and financial analysis.

The Paystand-Sage Integration Advantage

By integrating Paystand with Sage financial systems, businesses can unlock significant benefits, particularly in accounts receivable management. Here are some key advantages:

1. Manage, Reduce, and Eliminate Payment Processing Fees

Credit cards remain a popular payment method in business, accounting for about two-thirds of transactions. However, the associated 3% transaction fee can result in significant costs, such as $90,000 annually on $3 million in revenue. The Paystand-Sage integration allows businesses to accept zero-fee, direct-bank payments through the Paystand Bank Network. Customers can select the lowest-cost payment option, eliminating unnecessary fees.

2. Streamline Collections Processes and Reduce DSO

If your business struggles with a high Days Sales Outstanding (DSO), the Paystand-Sage integration can be transformative. Late payments—reported by 92.6% of U.S. businesses—create cash flow challenges. This integration includes payment links and "pay now" buttons on invoices, expediting collections. Sage Intacct customers also benefit from virtual terminals that enable faster, more efficient B2B payments.

3. Automate and Reconcile Payments Instantly

Manual reconciliation is a significant pain point for finance teams. The Paystand-Sage integration streamlines this process by automatically matching payments to invoices and sales orders. This reduces labor costs and ensures accurate, up-to-date reports in Sage Intacct. With automation, businesses gain valuable insights into receivables, improving decision-making.

4. Enhance Security and Compliance

Data security and governance are critical in managing payments and accounts receivable. The Paystand-Sage integration prioritizes security with PCI DSS Level-1 certification, two-factor authentication, and role-level access. Customer payment data is securely stored using Funds-on-File tokenization, offering peace of mind to both companies and clients.

5. Seamless Integration with Sage Intacct

Paystand’s plugin enables seamless integration with Sage Intacct, enhancing payment capabilities and simplifying processes. Key features include:

- Embedding a "pay now" button on invoices sent through Sage Intacct.

- Directing payers to a branded portal where they can select their preferred payment method.

- Promoting free bank transfer methods to reduce credit card fees.

- Automating deposit creation, posting, and reconciliation.

Additional features include scheduled payments, automatic alerts, autopay, and recurring billing, further streamlining accounts receivable processes.

Unlocking Sage Intacct’s Automation Benefits

Businesses can revolutionize their receivables and revenue processes by leveraging Sage Intacct automation and Paystand’s innovative technology. Key benefits include:

- Time savings: Automating cash application and reconciliation frees up valuable time for finance teams.

- Elimination of transaction fees: Businesses can save over 50% on receivable costs by eliminating transaction fees.

- Advanced merchant services: Features like subscriptions, virtual terminals, and fee management controls enhance efficiency.

- Brand customization: Businesses can customize the payment portal and checkout interface with minimal upkeep.

- Fail-safes and support: Paystand offers comprehensive support and troubleshooting, ensuring smooth operations despite insufficient balances.

The Future of AR with Paystand and Sage Intacct

The Paystand-Sage integration is more than a solution; it’s a step toward financial freedom. By embracing Sage X3 AR automation and leveraging advanced account receivable software, businesses can escape traditional payment constraints and explore a more open financial landscape. Companies that adopt these evolving payment solutions will reduce costs and enhance their processes, scalability, and profitability.

Revolutionize your B2B payments with Paystand and Sage Intacct. Experience seamless transactions and transform your financial landscape today. Book a free demo to discover the benefits of sage financial systems and AR collections software.