SMART CHECKOUT

-

Solutions

Solutions

Unlock radically better economics by incentivizing profitable outcomes through fee-less and automated AR processes.

SMART CHECKOUT

SMART DATA

-

Integrations

Integrations

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

NetSuite Best Practices Kit

Learn the key elements for automating payments within NetSuite to streamline your payments process.

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

The Future of FinanceUncover the trends, tools, and strategies you need to stay ahead of the curve.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Learn About Our MissionPARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

CONTACT

Talk to the Paystand team today.

sales@paystand.com

(800) 708-6413Our Offices

HQ | SANTA CRUZ

101 Church Street

101 Church Street

2nd Floor

Santa Cruz, CA 95060Guadalajara

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Sage Intacct Payment Integration: Automate Invoice Payments & AR

Managing accounts receivable in Sage Intacct shouldn’t be costly or slow. Many businesses face manual processes and high fees. Paystand automates payments, enhancing efficiency and cutting costs by up to 80%, allowing your finance team to focus on strategy initiatives.

Join over 1 million businesses optimizing their Sage Intacct accounts receivable process with Paystand!

LEARN MORE

Learn More With Our Paystand Integration Resources

Keep 100% of Your Revenue with Sage Payment Solutions

Transaction fees reduce revenue and growth. Paystand’s Sage Intacct gateway helps avoid traditional costs, maximizing earnings and saving up to 50% in AR costs.

- Accept ACH, credit and debit cards, e-checks, and zero-fee payments via the Paystand B2B Network.

- Securely process payments via virtual terminal.

- Use Least-Cost Routing to optimize transactions and offset costs with built-in fee management tools.

- Improve security with multi-factor authentication and real-time fund verification.

Streamline Billing and Collections in Sage Intacct

A slow AR process hinders growth. Paystand speeds up transactions and provides a seamless payment experience experience.

- Send AR invoices and sales orders with Sage Click-to-Pay links for speed collections.

- Enable bulk invoice payments or scheduled recurring payments.

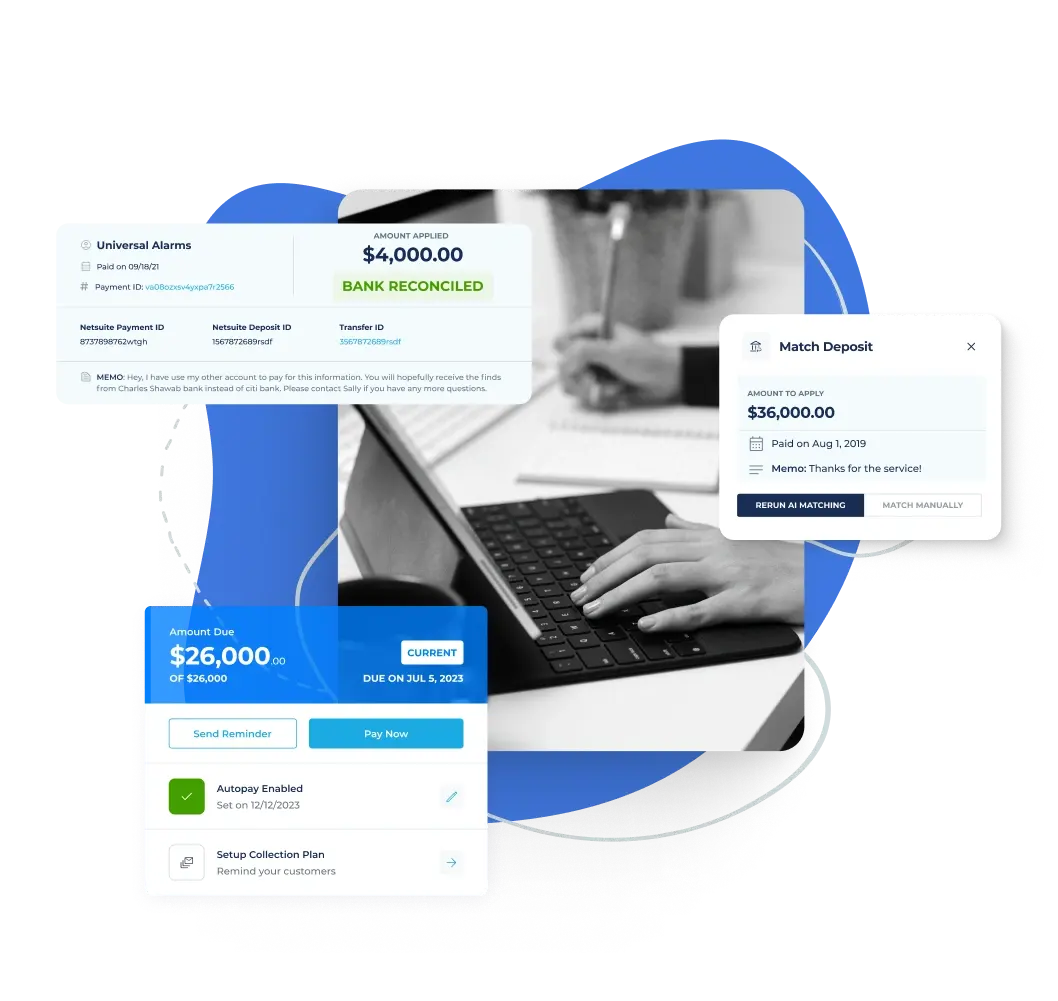

- Automate cash application, revenue recognition, and reconciliation with real-time data updates.

- Create financial reports and dashboards for better transaction visibility.

Seamless Sage Intacct Integration for Billing Automation

Payment reconciliation and reporting should be simple. Paystand integrates payments in real time, automating AR and AP in Sage Intacct.

- Sync payments and automate bank transfers for real-time reconciliation.

- Access additional integrations via Sage Intacct Marketplace.

- Control payment options, track invoices, and report from one dashboard.

Why Businesses Choose Paystand for Sage Intacct

Growing businesses need scalable payment solutions. Paystand helps companies eliminate manual processes and improve cash flow security.

- Faster time-to-cash: Reduce DSO by 60% or more with automated collections.

- Secure and compliant: Minimize fraud risk with advanced authentication and fund verification.

- Customizable workflows: Customize your payment process with flexible rules and expert support.

- Scalable for growth: Ideal for multi-entity enterprises using cloud-based ERP software.

“We found Paystand so easy to use; their embedded payment links in our invoices are simple for customers. Our clients and vendors are no longer confused at the critical moment when they're ready to pay."

.webp)

James Allen

CEO

Start Automating Payments in Sage Intacct

Manual processes, transaction fees, and slow payments can change. With Paystand’s Sage Intacct integration, streamline AR, cut costs, and get paid faster—keeping control over your cash flow.

Discover how Paystand can transform your Sage Intacct AR automation and start saving on transaction costs while improving financial management.

Talk to our Sage Intacct experts today

Sage Intacct FAQ

1. What is the Paystand integration for Sage Intacct?

Paystand is a digital payments platform designed for midsize and enterprise companies. Its integration with Sage Intacct enables businesses to accept payments online, streamline collections, and automate manual accounts receivable (AR) tasks. Features include embedded payment links, branded payment portals, and real-time reconciliation.

2. What are the key benefits of using Paystand with Sage Intacct?

Integrating Paystand with Sage Intacct offers several advantages:

- Faster Payments: Send AR invoices with embedded payment links and buttons to expedite collections.

- Flexible Payment Options: Accept partial and full payments for AR invoices and sales orders directly within Sage Intacct.

- Branded Payment Interfaces: Provide customers with branded payment portals supporting multiple payment methods.

- Improved Cash Flow: Reduce Days Sales Outstanding (DSO) by 60% or more.

- Enhanced Security: Decrease fraud and chargebacks through real-time fund verification.

- Better Customer Experience: Offer seamless and user-friendly payment options.

These benefits collectively help in digitizing receivables and moving manual financial processes to the cloud.

3. How does Paystand handle payment reconciliation within Sage Intacct?

The Paystand integration enables real-time cash application directly within Sage Intacct. Payments and daily bank transfers are reconciled automatically, with partial and full payments applied to invoices and sales orders instantly. Additionally, the system provides automatic transfer reports and ledger updates detailing deposits, transactions, and affected invoices or sales orders.

4. What payment methods does Paystand support?

Paystand supports zero-fee direct bank payments over the Paystand Bank Network, as well as credit cards, debit cards, and ACH payments at wholesale rates. The platform also offers features like Least-Cost Routing to direct customers to the most cost-effective payment options and the ability to implement convenience fees to offset transaction costs.

5. What are the requirements for integrating Paystand with Sage Intacct?

Integration requires the use of Paystand's SenderID. By utilizing the partner’s SenderID, businesses do not need to purchase a web services developer license from Sage, and API usage will not count towards the API performance tier. It's important to note that Sage may prevent customers from integrating with this application under their own SenderID.

6. In which countries is the Paystand integration for Sage Intacct available?

As of now, the Paystand integration is approved for use in the United States.

7. How will the integration supercharge my AR department?

Now, as a Sage Intacct customer, you'll be able to fully digitize the entire enterprise cash cycle within your trusted ERP. Paystand's partnership with Sage allows finance teams to unlock new potential with the following:

- Save up to 200 hours a year on manual AR tasks with features like automated cash application

- Streamline cash flow management with automatic reconciliation of daily bank transfer data

- Effortlessly reconcile deposits, refunds, disputes, fees, and adjustments

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.