Bitcoin as a Hedge Against Inflation

Bitcoin should work as a hedge against inflation. But does it? Could something be preventing Bitcoin from behaving as it should against inflation?

Let's explore the impact of inflation news on Bitcoin's value and learn how to utilize this knowledge for making well-informed investment choices.

You Know About Inflation, How About the Types of Inflation?

It's important to understand that there are three different definitions of inflation.

- When the prices of everyday goods and services increase, leading to a decrease in the purchasing power of money.

- A price increase in goods and services due to factors like supply and demand or disruptions in the supply chain.

- A natural expansion in the availability of certain resources or a scenario where the cost of goods and services usually goes up, followed by wage increases to maintain living standards.

We have experienced all three definitions of inflation at once. The rise in the prices of goods and services can be attributed to the substantial money printing undertaken by the US Federal Reserve since the onset of the pandemic—the Consumer Price Index is a reliable indicator to monitor these increases related to living expenses.

What is the Consumer Price Index?

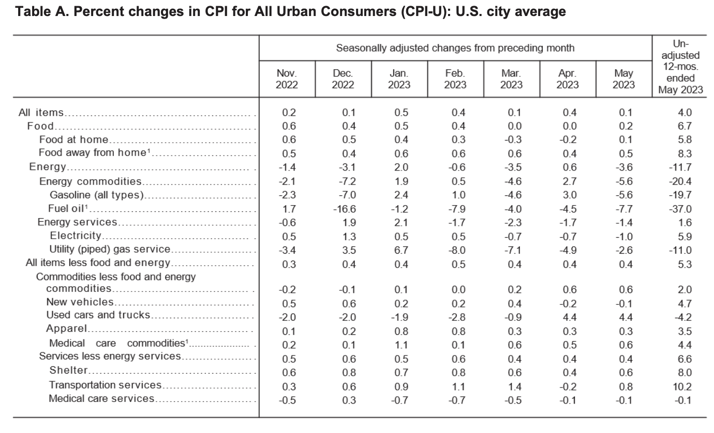

The Consumer Price Index (CPI) is a list of goods and services that the US government uses to gauge inflation rates or the increase of their prices.

It includes food, energy, clothes, vehicles, alcohol, tobacco, housing, medical care, and transportation. This index tracks the inflation of the costs of goods and services most people in the country need to spend money to subsist.

It is the rising cost of living-related goods and services and other items experiencing inflation. This is mainly due to the demand for certain products surpassing supply or production capacity. Factors contributing to this situation include supply chain disruptions, labor shortages, and employees being absent due to COVID-19.

Inflation and Shortages

A shortage of computer chips, stemming from both high demand and production limitations, has led to a significant increase in their prices. As a result, cars that use these chips have also risen in price. In turn, the cost of used cars has increased due to heightened demand and a shrinking supply of accessibly priced vehicles.

Additionally, we witness a form of inflation associated with the relationships between various factors, such as the increase in the cost of living leading to wage growth in certain situations.

Recently, wage increases have been more a product of workers’ labor shortage than just inflation alone.

How Bitcoin was Designed to Hedge Inflation

In the case of Bitcoin, its creator, who goes by the pseudonym Satoshi Nakamoto, programmed a built-in inflation mechanism into Bitcoin itself.

Bitcoin was programmed to a maximum supply, so the total number of bitcoins that can ever circulate is no more than 21 million units. This 21 million unit maximum was established to mirror gold's stable inflation rate.

Around 18 million bitcoins are circulating out of the total supply of 21 million. New bitcoins are introduced into circulation through mining, which occurs when new blocks are verified on the network.

Another characteristic programmed into Bitcoin is what we call halving events.

What is Halving in Bitcoin?

Halving is a process in which Bitcoin block rewards given to miners are reduced by half. This event occurs every 210,000 blocks, translating to approximately every four years on average.

The most recent halving took place in May 2020, decreasing the block reward from 12.5 Bitcoin to the current rate of 6.25. Consequently, around 900 new bitcoins enter circulation daily until the next halving event. As it stands, this results in an annual inflation rate of 1.8%.

The halving mechanism in Bitcoin's mining algorithm was designed to combat inflation by preserving a sense of scarcity. Theoretically, by slowing down the rate at which new Bitcoin is created, its price should rise if demand stays constant.

Why a Fixed Supply of Bitcoin is Good

One advantage of having a fixed supply is that Bitcoin's inflation rate will eventually reach zero once the last coin has been mined. The final Bitcoin is expected to be mined around the year 2140, which is approximately 120 years from now.

A fixed supply coupled with high demand creates scarcity, often increasing the value of assets like gold. This trend can also be expected for Bitcoin, as seen in its performance during past halving events.

On the contrary, the US dollar does not have a fixed supply. This allows the government to print more fiat currency whenever necessary, which has happened frequently lately.

This demonstrates how Bitcoin was designed to serve as a hedge against inflation, and over the past decade, it has successfully fulfilled this role in the long term.

However, what about the short term? Let's look at how Bitcoin's price has affected recent inflation data.

Bitcoin Works as Inflation Hedge, Except When…

Back on November 30, 2021, Federal Reserve Chair Jerome Powell mentioned that the Federal Reserve would accelerate the pace of the tapering of quantitative easing. But what does quantitative easing even mean?

Quantitative easing is a financial policy term that refers to increasing the amount of money circulating within the economy. When the Federal Reserve begins to taper quantitative easing, it will reduce the amount of money being printed and introduced into circulation.

As a large portion of the funds provided by the Federal Reserve has gone to major corporations, this tapering implies that less money and liquidity will be available for these corporate entities sooner than anticipated.

What happened next?

Riskier assets in the traditional markets, like tech and software, had a significant sell-off. Guess what else did? Cryptocurrencies.

Considering Bitcoin's price movements in April and May of 2021, we can observe that its price peak coincided with the release of CPI inflation reports.

After the reports revealed high inflation rates, Bitcoin and the rest of the cryptocurrency market experienced a downward trend.

You might wonder why Bitcoin, intended to hedge against inflation, experiences a price drop in response to high inflation reports. The answer lies in the complex interplay between Wall Street, politicians, and corporate entities involved in regulation.

The Power of Institutional Investors on Bitcoin Behavior

In recent years, institutional investors have come to represent over 70% of all trading activity in the crypto market. This means these large investors conduct a significant portion of cryptocurrency transactions. Many of these corporations held assets sold off when they were caught off-guard by new Federal Reserve policies.

Although one might expect that the average trader holding bitcoin off exchanges would reduce the available supply and drive up prices due to increased demand, large corporations and institutional investors are suppressing its price through:

- Their trading activity

- Creating an artificially higher supply of crypto to meet actual demand

Since institutional investors are responsible for most trades in the crypto market and higher inflation means less free money for them to work with, they appear to be treating cryptocurrencies like high-risk tech and software stocks rather than as inflation hedges.

These investors have benefited from substantial amounts of free money and unlimited liquidity from the Federal Reserve over the past few years. However, as inflation rises, they will have less money to invest. In anticipation of this, they are selling off what they consider riskier assets, including bitcoin.

However, this trend will be temporary until interest rates lower. When this happens, it might be great to be already holding Bitcoin.

Reasons to Hold Bitcoin

Many institutions are still holding Bitcoin for storing value, especially against inflation. These are the main reasons why they do so:

- Store of value. Like gold, Bitcoin is widely regarded as a digital store of value.

- Diversification and inflation hedge. Many companies view Bitcoin as a means to diversify their asset portfolio and protect against inflation.

- Capital appreciation potential. Bitcoin has demonstrated significant price growth, making it an appealing investment for companies that believe in its long-term potential and anticipate its value to rise.

- Currency diversification. Companies seeking to diversify their currency holdings beyond traditional fiat currencies and reduce exposure to country-specific geopolitical and economic risks.

- Payment option. Holding Bitcoin allows companies to receive payments in digital currency and potentially enjoy lower transaction fees than conventional payment systems.

- Strategic positioning. Embracing Bitcoin signals to investors, customers, and the broader market that a company is forward-thinking, innovative, and receptive to new forms of value exchange.

- Access to decentralized finance (DeFi). Bitcoin can serve as collateral in decentralized finance protocols, granting access to lending, borrowing, and other financial services without relying on traditional banking systems.

However, Bitcoin has been known to experience significant price volatility, which has deterred potential holders from starting to purchase Bitcoin.

How Paystand is Opening Access to Bitcoin

At Paystand, we firmly trust Bitcoin as the next greatest store of value. We hope the rest of the world will soon feel the same. But we aren’t just hopeful, we want to be the ones who help pave the way.

If owning Bitcoin was free to you, it would be a no-brainer, right?

This is part of the reason we implemented Bitcoin rewards in our products. At Paystand, we have launched a Corporate Spend Card that not only streamlines expense management but also gives you money back on your purchases in the form of Bitcoin.

“Selling high and buying low” is the dream. But obtaining Bitcoin for free is even greater than that. “Get free, sell whenever” with Paystand Spend.

By being here, you're already one step ahead. Embrace this unique opportunity to create wealth through the innovative and exciting world of new technology. It is a great moment to hold Bitcoin and make the most of this once-in-a-lifetime chance.