SMART CHECKOUT

-

Solutions

Solutions

Unlock radically better economics by incentivizing profitable outcomes through fee-less and automated AR processes.

SMART COLLECTIONS

SMART DATA

-

Integrations

Integrations

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

NetSuite Best Practices Kit

Learn the key elements for automating payments within NetSuite to streamline your payments process.

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

The Future of FinanceUncover the trends, tools, and strategies you need to stay ahead of the curve.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Learn About Our MissionPARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

CONTACT

Talk to the Paystand team today.

sales@paystand.com

(800) 708-6413Our Offices

HQ | SANTA CRUZ

101 Church Street

101 Church Street

2nd Floor

Santa Cruz, CA 95060Guadalajara

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Zero fees

The Paystand B2B Network is our zero-fee, digital payment network that gives you access to real-time fund transfers. Our proprietary Least Cost Routing technology lets you turn on legacy payment rails in your online checkout while still helping customers make the shift to zero-fee, digital payments.

This gives you more control over your costs while maintaining flexibility for your customers. You can even offer alternative payments that calculate your customer's savings in the checkout window.

Upgrade to Smart Payment Processing

Speed up your time to cash and increase customer engagement

The Paystand B2B Network is the most complete digital payment network available to businesses. We offer automated settlement to deliver your funds quickly and securely.

Our Payments-as-a-Service model is the industry's first value-based, SaaS deployed software platform for payments. Instead of giving up a percentage cut of your transactions, our flat-rate plans reduce your costs and increase profit margins.

Real-time fund verification

Connect instantly with over 98% of all banks to authenticate identity, verify good funds, and track payment settlement. With our real-time fund verification, you can immediately determine if you have sufficient funds to pay. This eliminates chargebacks, processing fees, and costly, time-intensive follow-up.

Seamless payments

From branding to checkout to fund transfer, the Paystand B2B Network is the most seamless and intuitive way for you and your customers to send and receive money.

Our checkout experience makes the payment touchpoint a memorable one for your customers. And with full customization and a powerful set of APIs, you have ultimate control over the payments experience.

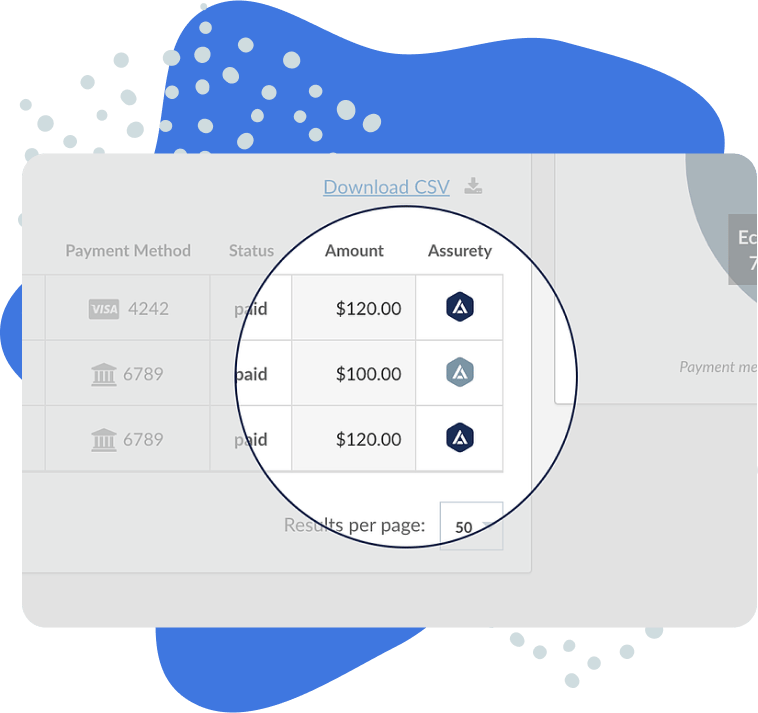

Built-in Assurety

Assurety is the blockchain-based, payment authentication process unique to the Paystand B2B Network. It creates an automatically notarized record trail that is secure, certified, and fully auditable. Records can’t be altered in any way, assuring transactions on the Paystand B2B Network are valid and free of tampering.

- Identifies fraudulent receipts in real-time.

- Guarantees payments are free of tampering.

- Provides verified, fully-auditable payment history

Deliver a faster, better payments experience

Drive more revenue and decrease DSO without compromise.

Automated Bank Login

Connect instantly with 16,000 banks to authenticate identity, verify good funds, and track payment settlement. Your customers can use their online bank login to instantly connect and pay with verified funds in real-time.

Autopay Fund-on-File

Fund-on-file lets you authorize, charge, and re-use your customers' payment methods without accessing their private information directly. And it's easy to set up automated, recurring billing, too. Set up monthly, annual, or custom payment schedules.

Robust Payer Portal

Give your customers one place to go for all payments. Our Payer Portal provides a comprehensive overview of all payments your customers have made through your branded or embedded Paystand Checkout and Billing Portal.

Verifiable Receipts

Every payment transaction over the Paystand B2B Network is recorded on the blockchain and is accompanied by a verifiable receipt sent to the payer. Your payers can access and print a permanent record of their payment at any time.

Highly Customizable

You've worked hard to establish your brand, and your payment system shouldn't interfere with that. Paystand offers several levels of custom branding from embedding your logo on the checkout window and receipts, to a full white-label integration.

Comprehensive Security

From PCI compliance and AML laws to Bank KYC underwriting requirements and fraud monitoring, we handle the complexity involved with payment processing so you can focus on what you do best.

Faster time-to-cash

Speed up time-to-cash and reduce DSO by over 50% when using the Paystand B2B Network to send and receive money.

Assurety blockchain

Access a fully auditable, permanent record of any payment transaction with 100% certainty it has not been altered.

Save money

Deliver a superior customer experience while driving down costs by offering our zero-fee digital payment option.

“We found Paystand so easy to use; their embedded payment links in our invoices are simple for customers. Our clients and vendors are no longer confused at the critical moment when they're ready to pay."

.webp)

James Allen

CEO

Talk to our team today

Schedule a demo with one of our payment experts to learn how Paystand can automate your entire AR process and save you over 50% on the cost of receivables. It's time to rethink payments with Paystand.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.

-1.png?width=1004&height=913&name=Group%201173%20(1)-1.png)