SMART CHECKOUT

-

Solutions

Solutions

Unlock radically better economics by incentivizing profitable outcomes through fee-less and automated AR processes.

SMART COLLECTIONS

SMART DATA

-

Integrations

Integrations

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

NetSuite Best Practices Kit

Learn the key elements for automating payments within NetSuite to streamline your payments process.

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

The Future of FinanceUncover the trends, tools, and strategies you need to stay ahead of the curve.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Learn About Our MissionPARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

CONTACT

Talk to the Paystand team today.

sales@paystand.com

(800) 708-6413Our Offices

HQ | SANTA CRUZ

101 Church Street

101 Church Street

2nd Floor

Santa Cruz, CA 95060Guadalajara

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Smarter B2B Payment Solutions for Modern Finance Teams

Paystand’s B2B Payment Solutions deliver an end-to-end, automated approach to getting paid. By combining accounts receivable automation with flexible, secure digital payment solutions for businesses, we help you streamline your entire payment cycle, reduce operational costs, and unlock faster cash flow without the fees.

Unlock B2B Payment Automation from Checkout to Cash

Your payment experience shouldn’t feel like a bottleneck. With Paystand, B2B sellers can provide customers with a fast, intuitive, and flexible payment process while automating back-end operations to drive efficiency.

Our automated B2B payments solution supports a full range of payment options, including ACH payments for B2B, wire transfers for businesses, commercial credit card processing, and EFT solutions. That means fewer abandoned payments, faster reconciliation, and less manual chasing.

Whether your customers are paying invoices, placing wholesale orders, or scheduling recurring payments, Paystand's integration ensures a seamless experience powered by an intelligent payment gateway designed specifically for B2B transactions.

Automate Invoicing, Reconciliation, and Cash Application

Manual workflows are expensive, error-prone, and time-consuming. Paystand eliminates friction across the entire order-to-cash cycle by automating the most repetitive parts of your accounts receivable process.

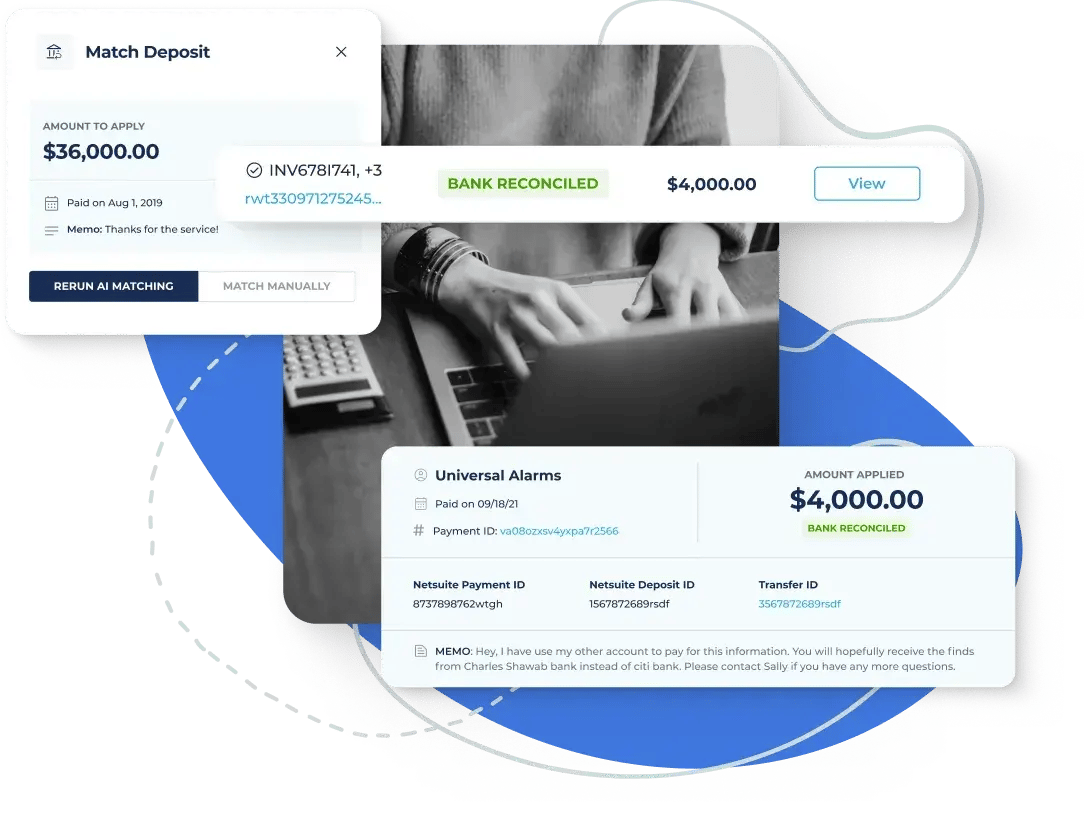

With our automated invoice processing, finance teams can generate and send invoices automatically, track payment statuses in real time, and reconcile transactions without touching a spreadsheet.

Our platform syncs with your ERP and accounting systems to ensure every payment is logged, matched, and applied. No spreadsheets, no lag time. It’s B2B payment software that thinks ahead so your team doesn’t have to look back.

Optimize Cash Flow Without Transaction Fees

You shouldn’t have to pay a premium just to get paid. Traditional B2B payment processing models often come with hidden fees, slow settlement times, and limited control over how payments are routed.

Paystand flips that model by offering zero-fee digital payment solutions for businesses, leveraging a proprietary payments network that minimizes cost and maximizes liquidity. You can:

- Route payments via the most cost-effective channel

- Reduce card processing fees through intelligent payment optimization

- Improve cash flow by accelerating time-to-cash and reducing DSO

With Paystand, B2B payment automation becomes a strategic advantage, not just a back-office function.

Strengthen Payment Security and Compliance

B2B transactions involve large sums, complex approval chains, and high stakes, which makes payment security non-negotiable. That’s why Paystand is built with enterprise-grade security and compliance baked in.

Our platform supports payment verification, encrypted data transmission, and full audit trails across every transaction. Whether you’re accepting wire transfers for businesses, processing large-volume ACH payments, or using commercial credit cards, you can trust that every transaction is protected and compliant with industry standards.

Our tools help you maintain control, reduce fraud risk, and demonstrate compliance without sacrificing usability.

.png?width=950&height=813&name=AI-match-header%20(1).png)

What We Do

Take a quick look at how we handle the payment process.

However, if watching videos is not for you, we've added an interactive payment experience at the button below.

Designed for Scale and Flexibility

As your business expands, your payment infrastructure needs to keep up. Paystand’s B2B payments software is built to scale across teams, regions, and subsidiaries without sacrificing control or flexibility.

From a centralized dashboard, you can create custom payment workflows, automate early payment discounts, and manage multi-currency or multi-entity operations.

From mid-market manufacturers to enterprise wholesalers, leading B2B brands trust Paystand’s B2B payments software to support their digital transformation and accelerate growth. And since the platform is no-code and cloud-native, deployment is fast and upgrades are seamless.

Real Results from Real Businesses

Companies that switch to Paystand aren’t just upgrading their payments; they’re transforming how they do business.

Our customers report:

Frequently Asked Questions

1. How does B2B payment automation improve operational efficiency?

B2B payment automation eliminates the need for manual tasks like invoicing, payment tracking, and reconciliation. By combining automated invoice processing with accounts receivable automation, businesses reduce errors, improve speed, and give teams more time to focus on strategic work.

2. What are the most secure B2B payment methods?

The most secure methods include ACH payments for B2B, EFT solutions, and wire transfers for businesses. These methods offer better traceability and lower fraud risk than paper checks, particularly when layered with features like payment verification and encrypted processing.

3. How can I start automating my B2B payments?

Start by integrating B2B payment software like Paystand. Once integrated, you can enable automated B2B payments, digitize invoicing, and connect your ERP for end-to-end B2B payment automation.

4. What are the challenges associated with traditional B2B payments?

Traditional payments are often slow, expensive, and prone to errors. Manual workflows delay cash flow and increase operational burden. Digital payment solutions for businesses address these problems by removing paper, reducing human input, and offering real-time visibility.

Get a Personalized Demo

Every B2B operation has unique payment challenges, so let’s tailor a solution for yours. Fill out the form below to schedule a personalized demo of Paystand’s B2B payment automation capabilities.

We’ll show you how automated systems, accounts receivable automation, and B2B payment solutions can help you get paid faster, lower costs, and operate at scale with less stress and more strategy.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.