ACCOUNTS RECEIVABLES

- Receivables

-

Payables

ACCOUNTS payables

WHY NOW

Our push into Accounts Payables comes with our mission of becoming the one stop shop for the CFO.

By integrating AP, our financial suite becomes even more powerful as we aim to automate everything money.

-

Payments

OUR NETWORK

Discover how we enable your business to receive fee-less payments at a faster speed than your current solution.

We transition your costliest payers into cost-effective payment rails to return the most positive of ROIs.

- Expense

-

Resources

DATA & INFRASTRUCTURE

LEARNING RESOURCES

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Payments as a ServicePARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

ABOUT US

See how we are rebooting commercial finance.

Where We Operate

United states

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.

Paystand is headquartered in California and operates nationwide, serving businesses across all 50 states.canada

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

We support operations in Canada with localized payment capabilities, including CAD EFT and cross-border support.

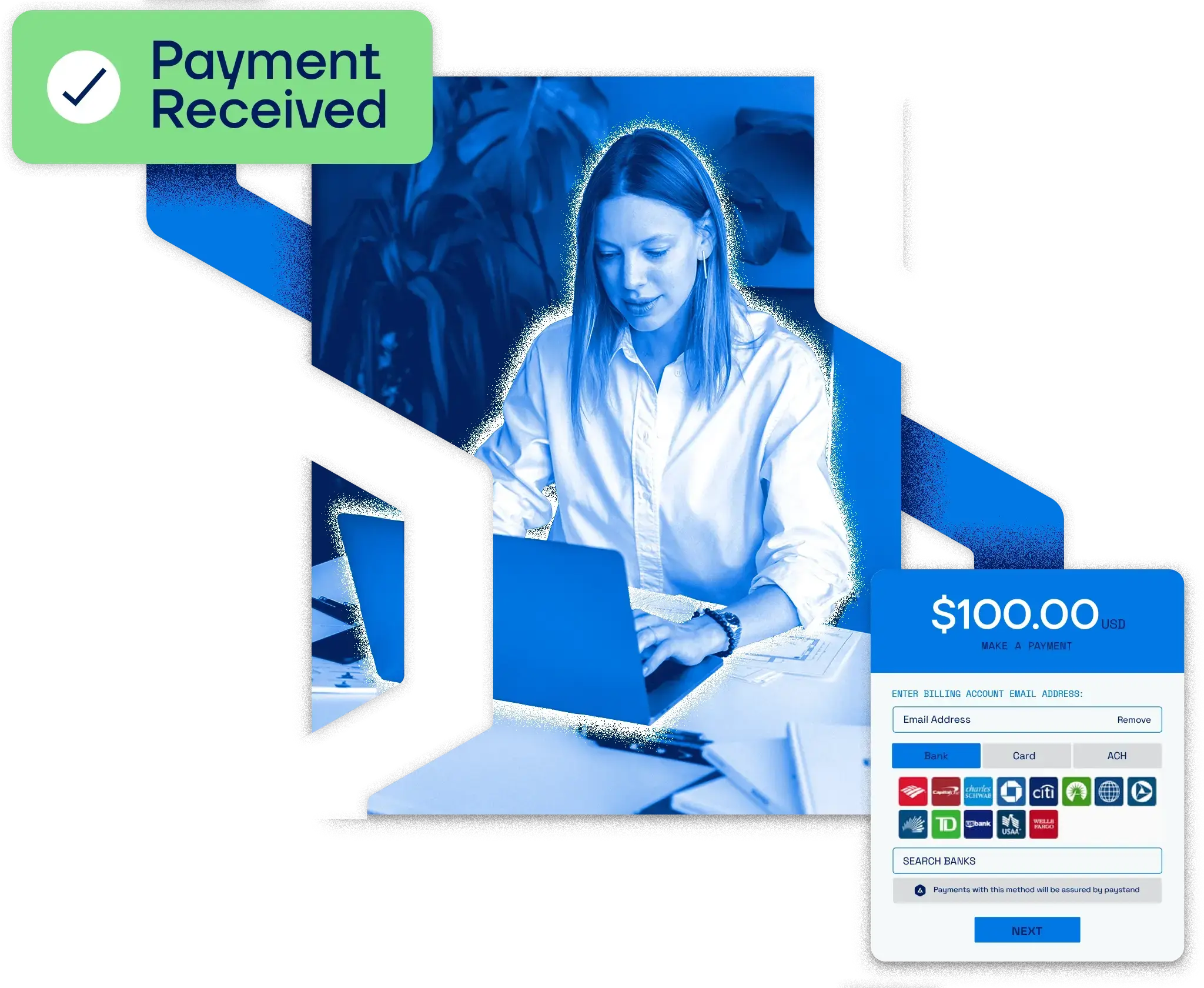

The Smarter Way to Send and Receive Bank Payments

The Paystand B2B Network is a modern bank-to-bank network built for fast, secure, and cost-effective business payments.

What Is Paystand’s B2B Network?

Unlike traditional payment systems that rely on costly intermediaries and slow processing times, Paystand’s B2B Network offers a direct business payments network with faster settlement, better control, and no transaction fees.

With our bank to bank Network, you can:

- Send and receive online bank transfers instantly

- Eliminate credit card fees and third-party processors

- Automate reconciliation within your ERP

- Use flexible digital payment methods to change payer behavior

- Access real-time payment insights and reporting

Benefits of Paystand's bank network

Faster Time-to-Cash

Bank-to-bank payments settle faster—often same or next business day.

No Transaction Fees

Our payment network eliminates costly per-transaction charges.

Secure. Scalable. Blockchain-powered

Built on encrypted, blockchain-based technology and compliant with top financial institution standards.

Connected to Millions

Join a growing B2B network that already includes over 1 million connected companies.

ERP Integration Ready

The bank network connects directly to NetSuite, Sage Intacct, Microsoft Dynamics, Acumatica, and more.

Payer Incentives That Work

Nudge customers toward preferred payment methods that optimize margin and control.

How does the Paystand bank network work?

Paystand’s B2B bank network facilitates direct online bank transfers without intermediaries. Here’s how it works:

- Your invoice is delivered via a digital payment link.

- Payers click the link to make a bank-to-bank payment.

- Funds are transferred directly to your account.

- Your ERP is updated automatically—no manual work needed.

The Paystand bank network reimagines payment and banking for modern finance teams who want better speed, insight, and control.

Testimonials

“Paystand has been a great tool for us. The reduction in manual effort has freed us up to provide a higher level of customer service and to be more diligent with collections.”

Will Jex

Controller

CASE STUDY

Elenteny Imports Case Study

Learn how Elenteny Imports used Paystand's bank-to-bank network to cut costs, accelerate cash flow, and double invoice volume without increasing headcount.

Frequently Asked Questions

1. What is Paystand’s bank network?

It’s a business payments network that connects companies for real-time, zero-fee bank-to-bank payments. It replaces outdated systems with a blockchain-enabled alternative that is secure, fast, and ERP-integrated.

2. How do direct bank transfers differ from ACH?

ACH transfers typically take 2-5 business days and rely on legacy infrastructure. Direct bank transfers through Paystand's B2B Network are faster, more secure, and processed in near real-time.

3. How does it differ from other bank transfer software?

Most bank transfer software operates in isolation. The Paystand bank network is connected to millions of businesses and offers embedded incentives, reporting, and full ERP automation.

4. What are the benefits of using Paystand’s B2B Network?

You’ll eliminate transaction fees, speed up collections, reduce risk, and gain deep financial insights—all while connecting to a modern bank payments network.

5. How long does it take to make a payment through the bank network?

Most bank-to-bank payments process in 1 business day or less, depending on the payer's bank.

6. Is Paystand’s B2B bank network secure?

Yes. It utilizes blockchain infrastructure and encrypted protocols to safeguard sensitive financial data throughout the payment lifecycle.

Request a demo & Join Our Network

Start using smarter, zero-fee bank-to-bank payments.

Over 1 million businesses already use the Paystand bank network to speed up payments and reduce processing costs by up to 80%.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.