Why Paystand Raised $20M to Fix Commercial Payments

Today is a big day for Paystand: We closed a $20 million Series B investment round from the same venture teams that invested in Coinbase, Gusto, Intacct, Coupa, PayPal, Avalara, and many others. We’d like to welcome DNX Ventures, Battery Ventures, Epic Ventures, Commerce Ventures, and Wildcat Ventures as new investors, as well as welcome Roman Leal from Leap Global Partners as our newest board member.

In 2017, we raised a Series A led by BlueRun Ventures in order to scale our products and make it easier for businesses to collect and send money. Since then, we’ve quadrupled our team, grown revenue by 8.5x, and launched several products to further our mission of rebooting commercial finance and creating an open, digital infrastructure for B2B payments.

Our platform has also grown significantly, reaching 120,000 businesses transacting on Paystand’s network. It’s a huge milestone, and I thought I’d unpack why we raised $20 million and what this means for our customers and the B2B payments space.

Eliminating Friction

Businesses have clear (but often complicated) financial tasks they have to complete, and they deal with all sorts of obstacles to managing something as important as revenue. These processes are highly manual and prone to error, which lead to failed payments and hours of wasted time on data entry. In fact, the average business loses up to 25% of revenue due to poor billing and collections practices.

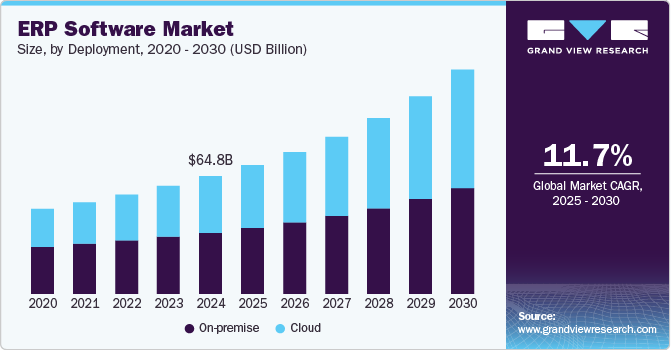

Meanwhile, the teams who execute these processes have their own set of challenges. They’re trying to do the important work of keeping the company’s finances healthy, yet they’re constantly under pressure to improve and scale their operations. The expectation is to stay competitive by investing in automation. That’s why these businesses are spending more on cloud and Enterprise Resource Planning (ERP) software.

North America ERP software demand, by function, 2012 - 2022 (USD Million)

And yet the tools available to them aren’t all that helpful. Most payment solutions simply offer digital versions of the same clunky practices that have been around since the 1970s. Instead of replacing the infrastructure that leads to these problems, they build on top of it and specialize in transferring information from one platform to another. Since the information remains siloed, maintaining these systems to reflect the same data is a pain, and even the best solutions fall short because they add extra steps to the payment process. It’s a mess.

Other solutions apply consumer-level technology that’s far too focused on the transaction. That may be okay for consumer payments, but commercial transactions are much more involved. They involve contracts, negotiations, invoices, nuanced payment terms – in some cases it can take weeks, months, or even years before the transaction happens. If the only thing your product is solving for is the transaction, you miss all the critical pieces the business relationship is built on.

In short: B2B payments is a $56 trillion industry built on top of broken plumbing.

A Smarter Approach to Payment Infrastructure

Legacy payment processors and automated workflows alone aren’t cutting it.

There are two missing ingredients to solving this infrastructure problem: a digital-first approach and an Open Industry philosophy.

Digital First

Commercial payments don’t need a slight iteration or incremental change; we need to rip out these clunky, outdated legacy environments and replace them with new, digital infrastructure built around the internet.

Why does this need to happen? Because American businesses still write more than $12.5 trillion in paper checks annually and the processing costs for that are as much $550 billion per year. And that’s just in the U.S. Consider that half of all global commercial payments are still made with paper checks. Mastercard estimates that the global B2B payment volume is at $125 trillion – that’s $62.5 trillion in payments that should be made more efficiently.

Consumers have more options than ever for sending payments quickly by credit card. On the other hand, for businesses that’s a costly problem. Paying a 3% credit card fee on a $100,000 invoice is a recipe for revenue loss. And while ACH and wire transfers do work, they all run over the same broken plumbing, so they’re slow, involve paperwork, are prone to fraud and security risk, and often come with additional fees for accessing the payment gateway.

Under this infrastructure, there’s no way for anything but a fee-based model to exist. We believe there’s something inherently wrong with that, so we ’re on a mission to change it.

We began building the Paystand Network 4 years ago to build a simpler, smarter way to send and collect money. Money moves electronically and instantly without any transaction fees. Businesses can verify that customers have funds before making a payment, because who doesn’t want fewer chargebacks and failed payments. And to top it off, we leverage cutting-edge blockchain technology to build trust and security directly into Paystand’s infrastructure – because the more self-policing the software does, the less work you have to do.

An Open Industry

As excited as we are about building better digital infrastructure for B2B payments, there’s an even larger shift happening towards a more open financial industry, and it’s beyond only one company. For too long, financial services have let us down with closed systems, fees, and cost structures that dominate the news with bad actors.

Time has proven that as technology and companies have become more open, they’ve produced better results for end-users. Our belief in a more open financial industry means securely exchanging data on our network using open blockchain standards so that any stakeholder can easily collaborate with us to create better tools, experiences, and outcomes for customers.

In the new digital environment, disconnected industries like financial services, supply chain, insurance, and manufacturing will all be linked and collaborating.

Up until now, the internet has only transformed how people exchange information, but it’s hardly put a dent in how industries like finance, insurance, and healthcare share sensitive data. There’s no method of trusting our counter-parties so we paid fees to institutions to enforce that trust.

We’ve always believed that the world could benefit from a more open, secure, and verifiable system, so we built the Assurety blockchain last year to offer organizations a secure way to share information with each other.

While "blockchain" has been a buzzword in the news for quite some time, we’ve been focused on proving a network at scale that can create value and ROI for our customers, saving them millions of dollars in fees, speeding up their time to cash, and automating their core financial services.

This creates compelling proof to our customers that blockchain technology is the next logical step for financial services, as opposed to being technology for technology’s sake.

Creating a smarter infrastructure to exchange data is the future of business.

That’s why we’re building Paystand.

Changing of the Guard in Fintech

At the same time, we’re seeing a changing of the guard in the fintech ecosystem. Whereas the last wave of fintech focused on consumer finance and brought us the Robinhoods and Betterments of the world, the next wave will be all about bringing the consumer experience to enterprise software.

Financial services has yet to have material innovation in purpose-built software that caters to this industry. We’re just entering the early stages of an entire infrastructure layer that is being built to drive value rather than to be commoditized.

We’re seeing the early signs of it with Visa’s acquisition of Plaid for $5.3B, a price tag that was dozens of multiples of their current revenues. Multiples that are not just headline grabbing, but represent how critical next-generation financial infrastructure is needed in the industry. And this is just one of the first dominos to fall in this next wave toward digital-first commercial fintechs. The winners will have a proven track record of giving customers access to high-value, enterprise-level services in tightly regulated industries – a wave that represents a once-in-a-century change to our economic structure.

To Our Customers

We can’t thank you enough. From the very beginning, you placed faith in our vision and joined us on our journey. Your feedback has been immensely valuable along the way, and with it, we’re ready to continue taking your business to new heights.

So, at a high level, here’s what we’re working on next:

- Substantially improving our existing products: Adding more integrations with various ERP software and releasing new features for our Built-for-NetSuite SuiteApp.

- Expanding our payment network: Launching a virtual AP card solution, enabling new ways to pay using 0% in-network payments, and building the next chapter for Open Industry through new products, services, and APIs.

We want to continue building this company with you, and I look forward to delivering on that this year. There’s still a lot of work to be done, but we couldn't be more excited about the future.

I tell our employees repeatedly that fundraising is not an achievement. It is just a small step on our journey to accomplishing our vision of rebooting commercial finance, and we’re only just scratching the surface.

If this mission interests you, please get in touch with us.