How Reducing Your DSO Can Solve Cash Flow Woes

Table of Contents

- What is DSO?

- What Factors Affect Your DSO?

- How to Calculate DSO?

- What Are the Disadvantages of a High DSO?

- How Can Paystand Help Reduce DSO?

Key Takeaways

- Reducing DSO strengthens cash flow by ensuring steady revenue, making it easier to cover expenses and invest in growth.

- Industry benchmarks provide guidance, but businesses should tailor their DSO strategies based on industry norms and seasonal trends.

- Automation speeds up collections by streamlining invoicing, sending reminders, and offering digital payment options for faster transactions.

- A proactive collections strategy, including clear payment terms, early payment incentives, and firm follow-ups, helps minimize late payments.

Many companies struggle to get customers to pay invoices on time, which is critical for cash flow. Understanding customer payment details is the first step to improving cash flow. Thus, many companies keep track of and aim to reduce DSO (Days Sales Outstanding).

Companies can easily manage and reduce DSO with the wide range of tools available. This makes them more agile and poised to take advantage of future opportunities. But it's essential to realize that people and processes must grow with technology to create sustainable change—especially in an area like AR.

Effective communication and collaboration between the sales team and the accounts payable department are crucial to ensuring timely payments and improving cash flow.

What is DSO?

DSO means Days Sales Outstanding, a key metric that measures how long it takes a company to collect payment after a sale. A high DSO indicates slow collections, which can lead to cash flow issues and limited liquidity for growth.

Understanding where your company’s DSO stands against industry benchmarks is crucial for making informed financial decisions. If a lower DSO is your objective, businesses can use a variety of strategies, such as optimizing invoicing, offering multiple payment options, and encouraging early payments.

Many CFOs and accounting professionals set goals by matching the company's DSO to industry benchmarks. For example, some measure success by measuring the average number of Days Sales Outstanding. According to a study by Euler Hermes, the average DSO for businesses worldwide is around 65 days.

But comparing your business's DSO to this average will not help. Many other factors need to be taken into account.

What Factors Affect Your DSO?

Several factors influence your DSO, impacting how quickly your business collects payments:

- Net payment terms – Longer terms (e.g., Net 60 or Net 90) extend DSO, while shorter terms help reduce it.

- Customer payment behavior – Late payments from customers increase DSO, while early payment incentives can improve it.

- Industry standards – Some industries naturally have higher or lower DSOs based on typical payment cycles. To understand your DSO, you'll need to compare it to other companies in your industry with a similar size.

- Invoicing and collections process – Inefficient invoicing, manual processes, or lack of follow-ups can delay payments and increase DSO.

- Payment methods – Offering digital payment options can speed up collections, whereas relying on paper checks can slow them down.

- Seasonal fluctuations – If your business experiences seasonal trends, your DSO in June may differ significantly from that in December. To get a more accurate view, consider analyzing DSO on a quarterly or yearly basis instead of just monthly snapshots.

By accounting for these factors, businesses can take proactive steps to manage and reduce DSO, improving overall cash flow and financial stability.

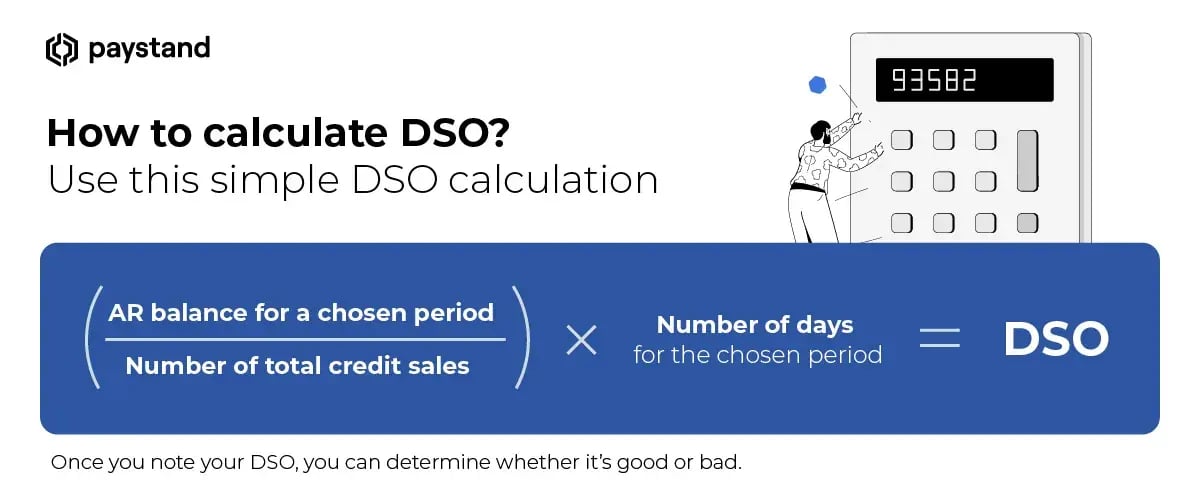

How to Calculate DSO?

To calculate days sales outstanding, start by deciding to consider your finance reporting. A monthly period is a good option. Then, find your accounts receivable balance sheet for your chosen period and divide that number by total credit sales. Finally, multiply your answer by the number of days. This value is your DSO.

What Is a Good DSO Target for Businesses?

Once you've benchmarked where your business’s DSO should be and calculated your specific DSO, the next step is setting a realistic target. A good DSO target depends on your industry, customer payment terms, and business model.

In general, a lower DSO is ideal, as it indicates that customers pay on time and cash flow remains strong. Many businesses aim for a DSO that aligns with or is slightly lower than their industry's average. For example, a DSO under 45 days is often considered healthy, while anything significantly higher may indicate collection inefficiencies.

If your DSO is higher than average, you should focus on reducing your DSO leveraging techniques, such as optimizing invoicing, adjusting payment terms, and offering early payment incentives.

What Are the Disadvantages of a High DSO?

A high DSO, or a steadily rising DSO, means your customers are slow to pay outstanding invoices, which can lead to significant financial strain. Businesses with a high DSO often experience cash flow issues, making it harder to cover operational expenses, invest in growth, or take advantage of new opportunities. When too much capital is tied up in unpaid invoices, companies may be forced to rely on credit or delay important initiatives, ultimately impacting financial stability.

Should You Focus on Reducing DSO?

Yes. Focusing on reducing DSO is essential for maintaining healthy cash flow and business stability. A high DSO puts pressure on a company’s liquidity, hindering its ability to fund daily operations or seize new opportunities. It can also create poor customer payment habits, leading to further delays or defaults.

Addressing DSO issues promptly helps ensure smoother cash collection, improves financial efficiency, and reduces the strain on accounts receivable teams. By focusing on reducing DSO, you can avoid cash flow disruptions and strengthen the financial health of your business.

How to Reduce DSO?

Improvement is possible in many areas, whether you clear up communication, offer incentives, or automate invoices. For example, one of the most effective ways to reduce DSO for businesses is to establish clear payment terms that encourage timely payments.

From an accounting perspective, reducing DSO involves streamlining internal processes to minimize delays. Here are nine DSO best practices to help you reduce DSO and increase cash flow:

1. Automating Invoices

The faster customers receive their invoices, the less time they will take to pay. As a result, automating your billing processes can be a very effective way to reduce DSO.

With automation, invoices can be sent out more quickly. It also eliminates the possibility of human error, meaning customers receive accurate, clear, and concise invoices. It also reduces delays; 75% of firms with automated AR processes said it provides a superior customer experience.

Automation can also help properly comply with customer invoice requirements. Customers often use order numbers when purchasing items, so invoices may get lost if they don't match up with valid order numbers. Be sure to obtain plenty of information about customer preferences for invoices, such as how invoices should be delivered, preferred contact information, and when payments are generally made. If invoices are consistent and regular, mistakes and delays are less likely to occur, which will reduce DSO.

2. Editing and Communicating Payment Terms

It may be a good idea to rethink your payment terms. Allowing customers to wait weeks to pay has become the accepted norm. Consider using a shorter payment term, such as a Net-14 instead of a Net-30. While you may lose some customers, this could save your company time and money in the long term.

It's also important to remember that customers can have legitimate reasons for paying late, and confusion can be considerable. If customers often call customer service with questions about payment terms, ensure that your terms make sense. Clear, simple payment terms that customers can access quickly and understand are ways to reduce confusion and prevent a high DSO.

If your invoicing software allows it, include payment terms in every invoice. Customers can reference the information as they complete the payment process.

3. Sending Reminders

It's easy to forget about payments or even misplace the invoice. A high DSO doesn't mean customers intentionally procrastinate payments. It could be simple, honest forgetfulness, which you can help fix.

Reminders can keep customers accountable and up to date on payments. Send them after the initial invoice and include information about the process, terms, deadlines, and rewards for early payments.

Following up on overdue invoicing processes can be done in various ways, such as emailing, texting, and calling. It might be a good idea to use multiple options, as different customers may prefer other modes of communication.

Easing payments can speed up customer payments. A service such as Paystand allows you to easily embed a "pay now" button on every invoice and reminder.

4. Offering Incentives

Offering rewards can incentivize early payments. For example, you could offer early payment discounts to customers who pay within ten days or provide sneak peeks at new services or products for customers who consistently pay early.

Make sure there are also consequences for late payments. If customers aren't penalized in any way for late payments, there's no reason to make an effort to pay on time.

5. Providing Different Payment Options

Digitizing your payment process by offering digital payment options makes things easier for the company and customers. Since paying online takes very little time, customers don't need to spend hours figuring out a complicated paper billing system. The benefits of digital payments make the process much faster and easier, encouraging customers to submit them promptly.

Sometimes, customers look for any excuse to avoid paying a bill. One way to ease this is to reduce the possible reasons by expanding the payment options you can accept. If you take multiple methods, customers will be more likely to find an option that matches their preferences.

Also, introducing digital flexibility, ease, and speed can help customers shift to paying how they prefer to receive money. For example, the Paystand Bank Network, a partnership with over 18,000 banks, offers zero-fee payment options.Consider offering a free, bank-to-bank transfer option alongside credit card options with a convenience fee. This will help cover transaction costs and shift to payment options that further reduce DSO. Ease of payment can be a significant factor in reducing DSO. Consider all the steps in an antiquated AR process:

- Customers receive paper bills

- They find their payment method and

- Write a check

- Or fill in a credit card number

- They mail their payment

- You receive the check or credit card numbers

- Checks are cashed

- Credit card numbers are manually entered before cash is available

Each of these steps can cause delays or errors.

6. Dealing With Late Payments

Sometimes, customers miss deadlines or don't pay at all, resulting in unpaid invoices. While this is annoying and often time-consuming, it is critical to have a clear plan for dealing with these situations.

We can all be forgetful sometimes, so start with friendly invoice payment reminders to help maintain a good relationship with your customer. If the delay were unintentional, your customer would pay immediately. Remember that convenient, varied payment options with embedded "pay now" buttons in all communications can make the request easy to fulfill.

However, if multiple reminders don't receive a response, you should consider walking away from the customer. Getting rid of potential business is always challenging, but if customers are regularly late on payments, they might not be worth the trouble.

7. Evaluating New Customers

Customers are an integral part of any business. As a result, you should carefully consider them and consider whether they're the type of clients you want to keep.

Removing problems before they begin will save you a lot of trouble later. Assessing customers includes running credit reports and checking customer websites for poor reviews. This should help weed out the most problematic customers before they cause trouble.

However, being too selective is impossible for your particular company, but you should set some parameters for new customers. Then, you can determine the minimum acceptable credit risk and accept potential customers based on that.

8. Using AI to Personalize Collections

Artificial intelligence (AI) and machine learning (ML) technologies provide data wealth to help you personalize collection processes. For example, AI and ML can analyze a customer's risk profile based on past behavior, payment history, communications preferences, etc.

This information can create more effective outreach based on payment terms, receivables, and particular categories. Automating the collection process in this way allows you to be more diligent about collecting past-due accounts with less effort, which leads to lower DSO.

9. Pruning High-Risk Customers

The bottom line is customers who routinely fail to pay their bills are not good.

Track customers who regularly pay late or not at all, especially clients who are unresponsive to communication efforts, and stop doing business with them. This means potential lost income in the short run, but your organization will save hours trying to manage those accounts and collect payments.

That time can be better spent working with customers with short-term payment issues, improving customer service for your best customers, or acquiring new customers who are more diligent about paying invoices on time.

Implementing one or more of these initiatives to reduce DSO requires continuous training, education, measurement, and recognition to keep your company focused on sustained change. In a department like AR, returning to comfortable, familiar ways of processing invoices and dealing with late-paying customers is too easy.

How Can Paystand Help Reduce DSO?

Effective management of accounts receivable is crucial for any business's financial stability. One key metric used to assess this is Days Sales Outstanding, which indicates how well a company performs. High DSO values can lead to cash flow problems and unpaid debts, resulting in limited liquidity for growth and investment.

To tackle this challenge, businesses need a sustainable, long-term approach to reducing DSO. Thumbtack, one of our clients, achieved a 40% reduction in DSO by leveraging Paystand’s automated payment solutions. By eliminating manual processes and accelerating collections, they improved cash flow and strengthened their financial operations.