How Payer Incentives Puts Money back into your Business: A Case Study

TL/DR; Implementing Paystand's Payer Incentives module creates significant shifts in payment behavior away from cards and saves businesses an average of 67% on punitive transaction fees.

"Proof is the bottom line for everyone." - Paul Simon

#NoFees.

Paystand is here to reboot commercial finance and move businesses to a better payment infrastructure — one that is cashless, feeless, and open. Note the second word: feeless. Delivering a payment infrastructure that eliminates fees and shifts businesses to a modern payment network is core to what we do.

Why? Because the existing, fee-based infrastructure penalizes businesses for growth and leeches money away from the balance sheet, draining value from our economy. We want to flip that script and return control of the enterprise cash cycle (and growth) to businesses — and our payment platform does so in the form of powerful technology that helps finance teams manage their cash flow.

In a previous post we introduced Paystand's Payer Incentives feature. It's built into our core AR module that every customer can access for no additional charge. Today, I'd like to share some profound data and customer behavior that demonstrates the power of this one feature and how it can materially impact your bottom line.

The Payer Incentives Module

To recap, the Paystand Payer Incentives module is a simple but elegant tool that gives businesses control over two powerful fee-control features:

- First, it gives businesses the ability to set payment incentives (in the form of invoice discounts) for choosing the zero-fee Paystand Bank Network or other non-card methods.

- Second, it lets businesses set convenience fees for credit card payments at a rate of their choosing.

You can think of this as both a carrot and a stick. Businesses have the power to incentivize behavior they would like (zero fee payments) and disincentivize less desirable behavior (credit card payments). In essence, this easy and intuitive technology helps businesses shift the balance of payment risk in their favor.

The Formula For Shifting Payment Behavior

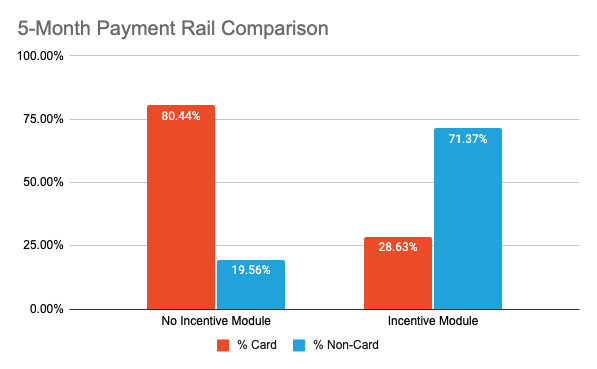

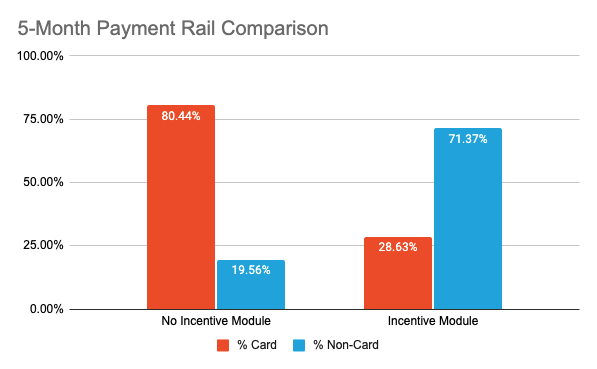

Paystand ran an analysis of two distinct customer groups to determine the effects of using our Payer Incentives module. Both groups comprised more than 100 unique customers, with payment volumes and payment mix being similar (i.e. both groups processed similar payment volumes with a baseline mix of cards, ACH, and bank-to-bank).

Over a five-month time period, Paystand monitored transactions, volume, and payment methods for over 250 customers. The resulting data is striking.

- When customers do not take advantage of the Payer Incentives module and offer all payment options to their payers, payers overwhelmingly choose to pay by card. In this segment, 80% of all payments were made via credit card.

- When customers do take advantage of the Payer Incentives module and incentivize payers via an invoice discount or charge a convenience fee on card transactions, 71% of all payments are made via ACH or the zero-fee Paystand Bank Network.

This means that when customers use the Payer Incentives module, they can literally alter the payment behavior of their payers to significantly improve their margins. We see payment behavior turn on its head when our customers choose to provide incentives for paying via more efficient, secure methods.

Savings Compound As A Business Grows

While many businesses swallow the 2% - 3.5% fee charged by the card networks as a necessary tax for doing business, at even modest revenue volumes, transaction fees add up. And at a revenue size, the costs simply become untenable for most mid-size and larger businesses. But by incentivizing payers to use more cost-effective options, savings are tangible.

Let's take a quick look: for smaller businesses processing between $3MM to $5MM being charged an average transaction fee of 2.58%, it means that over the course of a year, Paystand customers who use Payer Incentives save more than $43,000 that would otherwise be flushed down the drain to card networks. That $43,000 can now be redeployed to growth activities or more strategic projects.

But that's just the beginning. As is the case with a software-delivered payment infrastructure, these benefits increase as payment volume increases.

-

Customers processing $20MM in revenue with the same mix of card (80%) and non-card (20%) transactions seen by the non-Payer Incentives cohort would pay out over $412,000 in fees if not using the Payer Incentives module.

$20MM * .8 = $16MM in card volume —> $16MM * .0258 = $412K card fees

-

Using Paystand's Payer Incentives module, that same customer processing $20MM in revenue with the same mix of card (28%) and non-card (72%) transactions seen by the Payer Incentives cohort would save $124,000 each year.

$20MM * .28 = $5.6MM in card volume —> $5.6MM * .0258 = $144K card fees

$20MM * .72 = $14.4MM in non-card volume —> *.01 (average invoice discount) = $144K discounts$412K - $144K (cards fee savings) - $144K (invoice discounts) = $124K TOTAL SAVINGS

That's a big swing in cash savings to the balance sheet. The more a customer processes in payment volume, the greater their savings from punitive transaction fees that penalize them for growth. You can run the numbers with any credit card percentage and any shift in payment volume and the net result will always be savings on transaction fees.

The Bottom Line

Often times we hear: "my customers simply won't pay any other way" or "my customers just like paying over credit cards" but what we see from the data is when businesses provide more attractive payment alternatives, payers will choose them; they will choose them in spades! And businesses will enjoy a significant shift to less expensive or zero-fee payment rails, which puts money directly back into their bank accounts.