Four Keys to Adding Payments to Your Software Platform

It’s been said that “software is eating the world” - and it’s true. Software platforms for businesses (aka B2B software platforms) are proliferating at an accelerating rate, serving a dizzying array of business needs including accounting, project management, time tracking, billing, CRM, and many others. Developers are racing to fill the needs, creating broad-based “generic” platforms as well as highly specialized tools that cater to the specific needs of particular industries. So whether a company sells organic beverages to corner groceries or horse feed for thoroughbreds, there are probably multiple tools available to help them to better manage their business. The abundance of tools creates an imperative for platform providers to continuously add new capabilities to deliver value to their users. Increasingly, B2B software platform providers are turning to payment services as a key area of innovation.

Adding payments allows you to differentiate yourself quickly, easily, inexpensively, and without adding overhead to your operations. You can offer payments as a premium service upgrade option to your users to generate additional revenue. Adding payments can also be a major driver for customer acquisition. The key is to find a payment partner with a platform designed from the ground up to support your unique platform offering and business model.

The requirements for adding online payments for business software platforms are unique. While there are many things to consider, here are four of the most important things to consider when adding payments to your platform:

Are you a payments company?

Software companies employ really smart software developers who create the core value of their business. But few software companies employ experts in payments. The technical, legal, regulatory and business issues associated with handling money online are subtle and challenging. For example, successful B2B platform providers put significant effort into making it easy to onboard new customers, so they naturally want to want to make it as easy as possible for their customers to add online payments to their subscription. However, making sign-up for payments too easy exposes a platform provider to significant risks from fraud. Payment companies that support B2B platforms have special expertise in structuring an onboarding and approval process that makes it easy for downstream customers to sign up for payments while providing protections that mitigate against fraud.

Is your brand important?

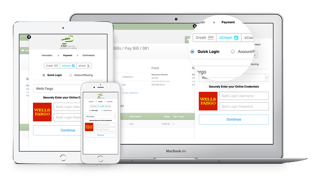

Many payment processors put their brand front-and-center and insist on controlling the payment experience that their users provide for their customers. With some payment providers, customers are redirected to the payment processor’s site to complete payments. A better approach is to have drop-in integrations that enable a B2B platform provider to support Web-based and in-app payments seamlessly, with their own branding.

Are the right payment options available?

The most common method for online payments is via credit card - but it’s also the most expensive, typically costing in the range of 2.5%-3% of the payment. Those high costs are a necessary evil for consumer e-commerce (B2C) businesses - and also a main reason why paper checks still dominate B2B payments. While there have long been electronic alternatives to paper checks, like direct bank debit (ACH), the experience for the payer for ACH is cumbersome and so many companies don’t use it. Newer solutions like eCheck make paying via electronic bank debit as easy as using a credit card, at a fraction of the cost. But many payment processors don’t provide compelling eCheck services because they make more money on credit card transactions.

Do you share in the revenue?

Many B2B software platform companies are surprised when they learn how significant payments can be as an added source of revenue. Payment processors who understand their customers’ businesses can craft a revenue share model that can easily double a platform provider’s revenue per customer, while providing their users with a much lower cost for payments.

There are many other compelling reasons for offering payment services. Cash flow and payments are the lifeline of every business. By aligning your platform services with these critical functions, your business becomes an integral part of your customer’s business. Payments are “sticky”, so customers using payment features are more likely to remain long-term customers. As their businesses grow, yours does too.

Adding payments to your platform is a smart business decision. It allows you to strongly differentiate your platform from the competition, increase revenue by offering payments as a compelling premium service, and retain those customers by aligning your platform with a critical business function. Choosing the right partner for your payments integration will ensure that you can integrate payments quickly and easily, while building the strength of your own brand.

Ready to learn more about adding payments to your platform? Drop us a line and we'll be happy to discuss integration options to best serve your customers and build your business.