Cash Flow Forecasting Made Easy: Tips and Tools

Table of Contents

- What is Cash Flow Forecasting?

- Benefits of Cash Flow Forecasting

- Common Cash Forecasting Mistakes to Avoid

- How to Build a Cash Flow Forecast for Your Business

- Cash Flow Forecasting Examples

- How to Calculate Cash Flow

- The Role of Technology in Cash Flow Forecasting

- How Paystand Transforms Cash Flow Forecasting

Key Takeaways

- Cash flow forecasting helps businesses predict future financial positions, manage liquidity, and plan for growth.

- Common mistakes include over-optimism, ignoring seasonality, and failing to update forecasts regularly.

- Building a cash flow forecast involves setting objectives, choosing a forecasting period, selecting a method, and gathering data.

- Technology, like Paystand, automates and streamlines cash flow forecasting for greater accuracy and efficiency.

What is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating a company’s future financial position by analyzing anticipated payables and receivables. By predicting future sales and expenses, businesses can gain insights into their financial health and make informed decisions.

Benefits of Cash Flow Forecasting

- Improved Financial Planning: Anticipate cash shortages or surpluses to make better business decisions.

- Debt Management: Ensure you have enough cash to meet loan or debt payments.

- Growth Opportunities: Identify when you’ll have enough working capital to fund new projects or expansions.

- Risk Mitigation: Spot potential cash flow issues early and take corrective action.

Common Cash Forecasting Mistakes to Avoid

- Over-Optimism: Overestimating future sales or underestimating expenses can lead to inaccurate forecasts.

- Ignoring Seasonality: Failing to account for seasonal fluctuations in revenue or expenses can skew your forecast.

- Lack of Regular Updates: Cash flow forecasts should be updated regularly to reflect changing business conditions.

- Overlooking Small Expenses: Even minor costs can add up and impact your cash flow.

- Relying on Incomplete Data: Ensure your forecast is based on accurate and comprehensive financial data.

How to Build a Cash Flow Forecast for Your Business

1. Identify Your Forecasting Objectives

Determine what you want to achieve with your forecast. Common objectives include:

- Growth planning

- Liquidity risk management

- Debt reduction

- Short-term liquidity planning

2. Choose Your Forecasting Period

- Short-term: 2-4 weeks (daily breakdown)

- Medium-term: 2-6 months (e.g., rolling 13-week forecast)

- Long-term: 6-12 months (annual budgeting)

- Mixed-term: Combines short, medium, and long-term forecasts

3. Decide on a Forecasting Method

- Direct Forecasting: Uses actual cash flow data for short-term forecasts.

- Indirect Forecasting: Relies on projected balance sheets and income statements for long-term forecasts.

4. Gather the Data You Need

Collect the following information for accurate reporting:

- Opening cash balance

- Cash inflows (e.g., sales, receivables)

- Cash outflows (e.g., expenses, payables)

Cash Flow Forecasting Examples

- Short-Term Example: A retail store forecasts daily cash inflows and outflows for the next two weeks to ensure it can cover payroll and supplier payments.

- Medium-Term Example: A manufacturing company uses a 13-week forecast to plan for raw material purchases and debt repayments.

- Long-Term Example: A tech startup forecasts cash flow for the next year to determine how much funding it needs for product development.

How to Calculate Cash Flow

The basic formula for calculating cash flow is:

Cash Flow = Cash Inflows - Cash Outflows

For example, if your business has $50,000 in cash inflows and $40,000 in cash outflows, your cash flow is $10,000.

The Role of Technology in Cash Flow Forecasting

Modern technology has revolutionized cash flow forecasting by:

- Automating data collection and analysis.

- Providing real-time insights into cash flow trends.

- Reducing human error and improving accuracy.

- Enabling scenario planning and predictive analytics.

How Paystand Transforms Cash Flow Forecasting

Paystand is a leading platform that simplifies and enhances cash flow forecasting through:

- Automation: Automates cash flow data collection and updates, saving time and reducing errors.

- Real-Time Insights: Provides real-time visibility into cash flow trends and forecasts.

- Integration: Seamlessly integrates with your existing ERP or accounting software.

- Predictive Analytics: Uses advanced algorithms to predict future cash flow scenarios.

- Customization: Tailors forecasts to your business’s unique needs and objectives.

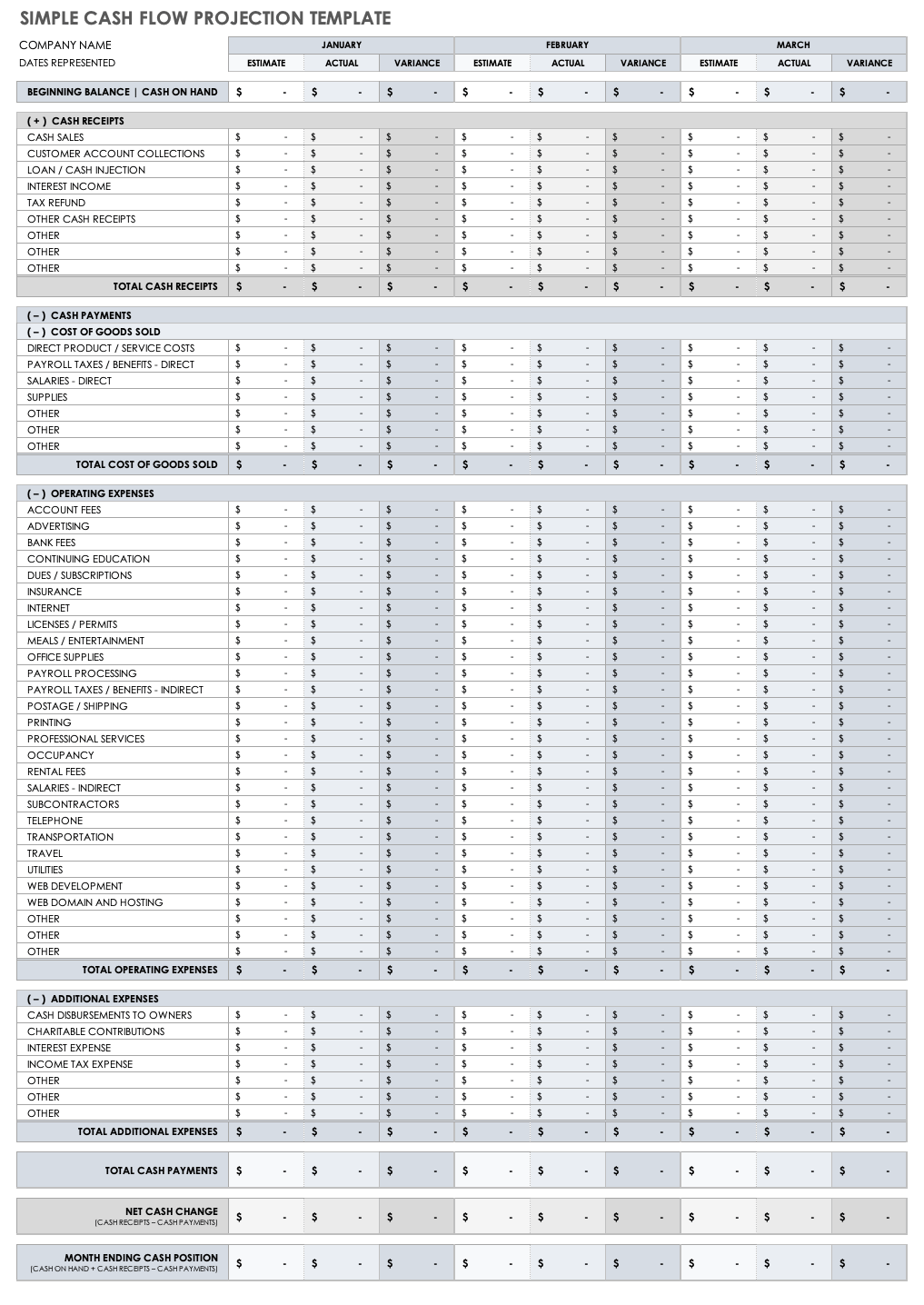

Simple Cash Flow Forecast Template

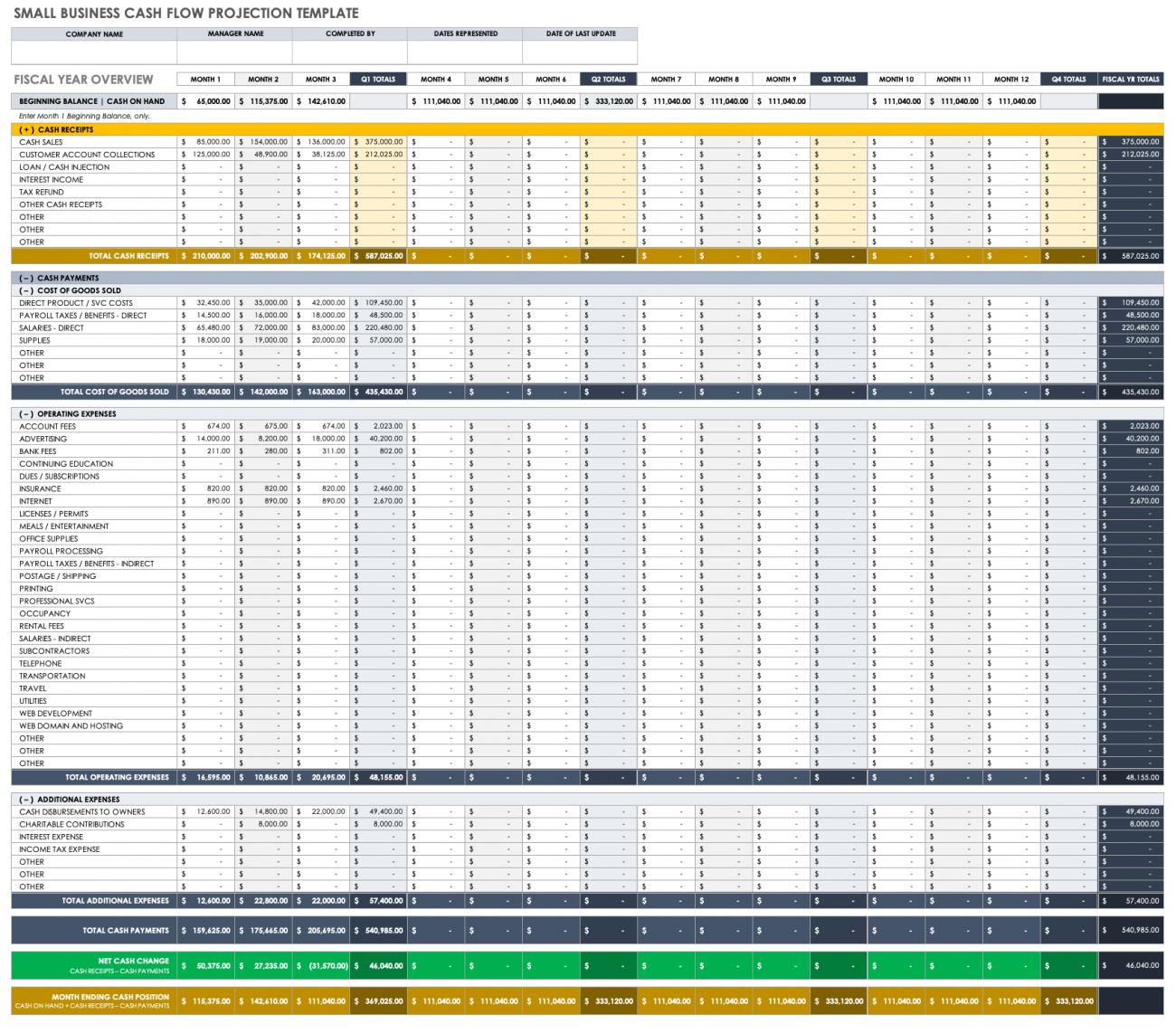

Small Business Cash Flow Forecast Template

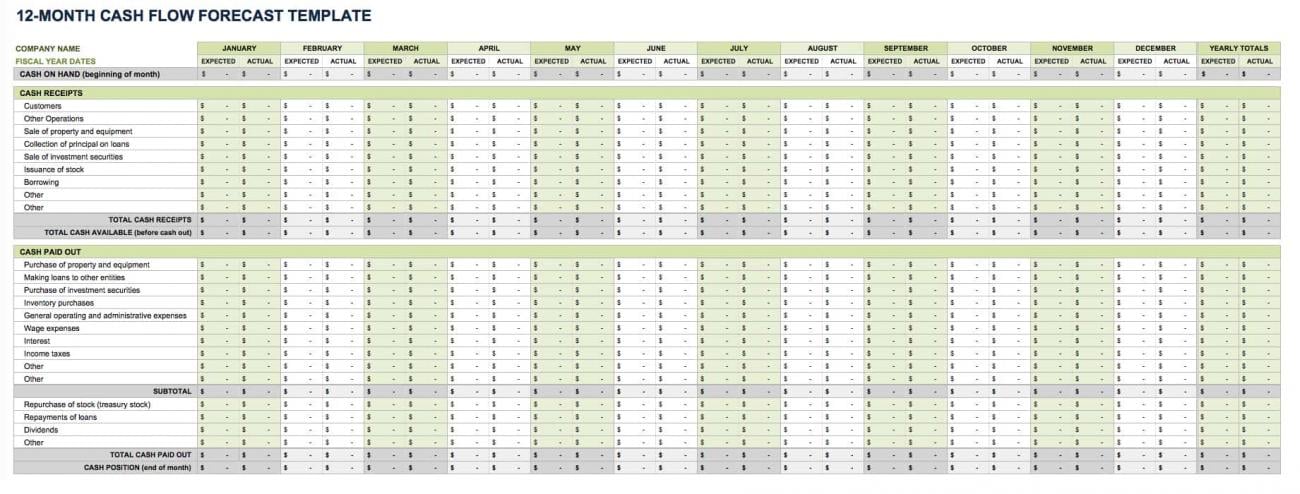

12-Month Cash Flow Forecast Template

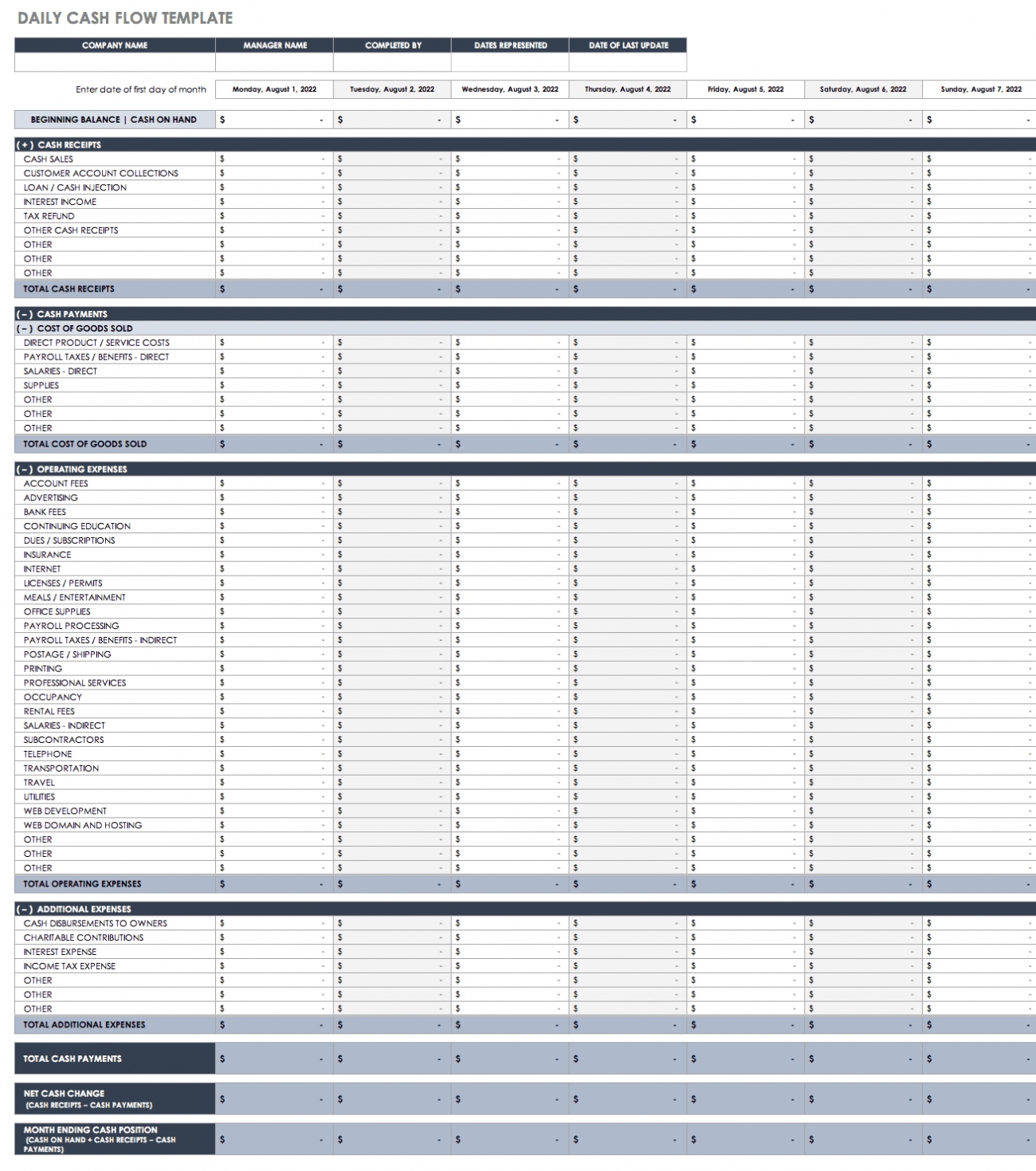

Daily Cash Flow Forecast Template

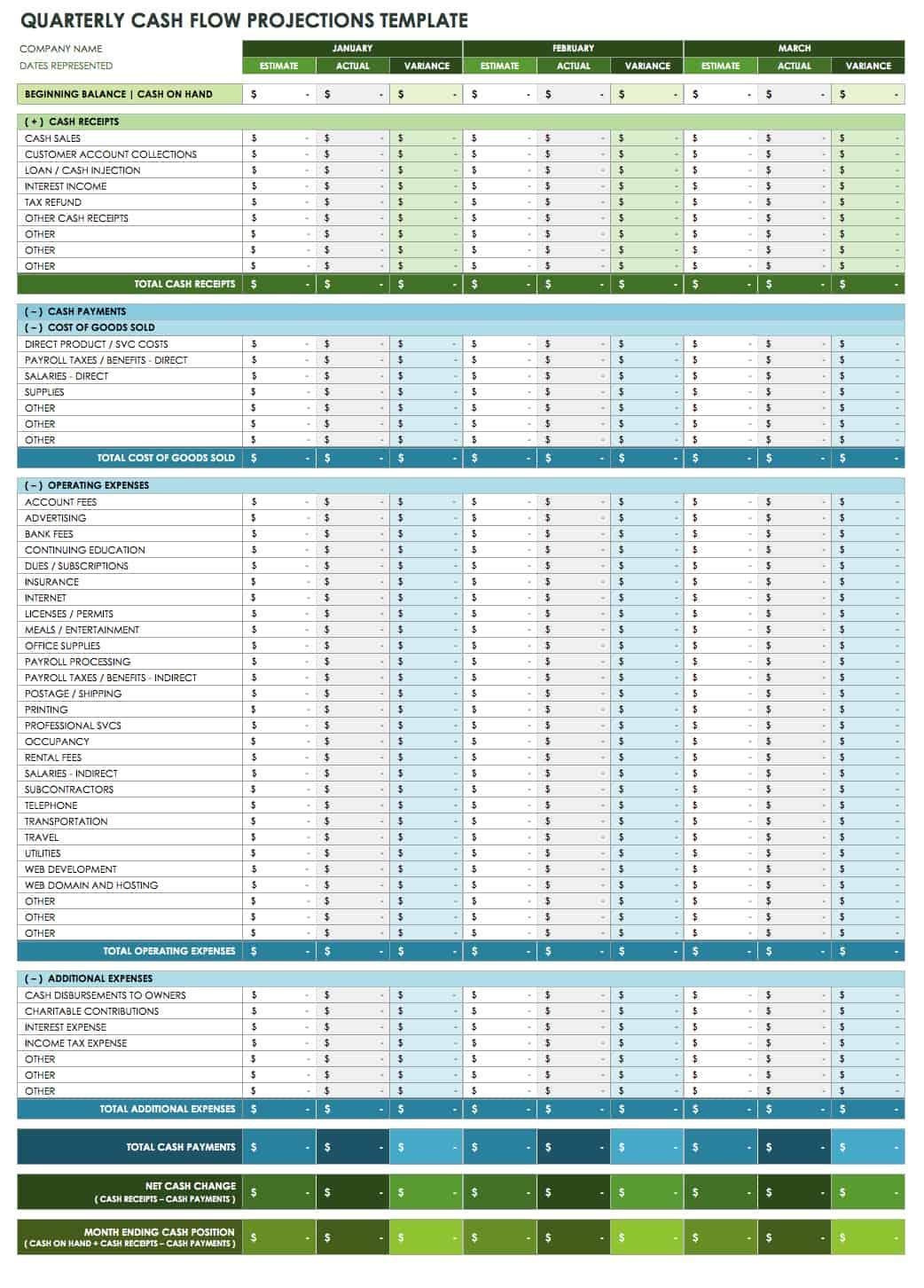

Quarterly Cash Flow Forecast Template

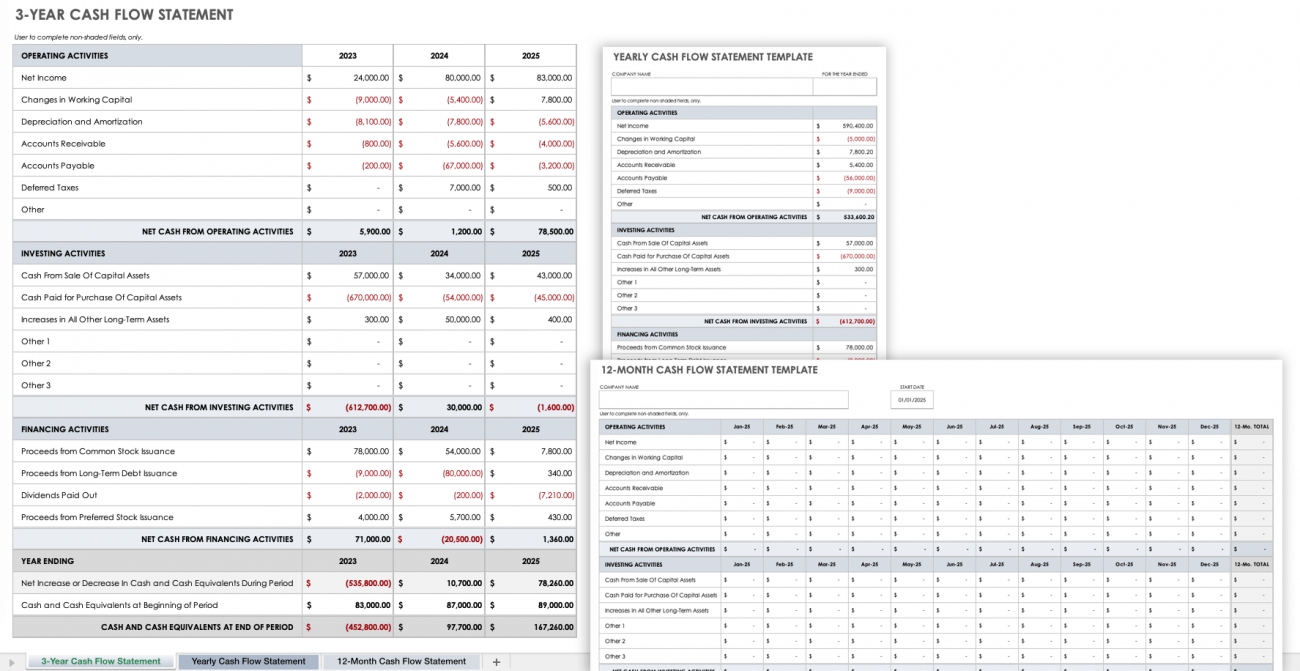

Three-Year Cash Flow Forecast Template

With Paystand, businesses can make smarter financial decisions, improve liquidity for improved financial management, and achieve long-term growth.

Cash flow forecasting is critical for any business looking to thrive in today’s competitive landscape. By avoiding common mistakes, leveraging technology, and using platforms like Paystand, you can gain greater control over your finances and pave the way for sustainable growth. Start forecasting today and unlock the full potential of your business!

%20(1)%20(1).jpg?width=100&height=100&name=IMG_3752%20(1)%20(1)%20(1).jpg)