Why You Need an Accounts Receivable Process Flowchart

Consider creating a flowchart if you're looking for ways to improve your accounts receivable process. An accounts receivable flowchart visually represents the collection process, highlighting areas of inefficiency and opportunities for automation.

Accounts receivable flowcharts are excellent for helping accounts receivable departments to visualize their processes. They often help pinpoint which areas are ripe for automation or improvement.

Not only can they effectively keep your team on the same page and train new employees, but they can also help you see areas of inefficiency.

How Accounts Receivable Flowcharts Give Structure to the Department

The larger the organization, the more complex the accounts receivable flowchart becomes. Each business unit has different processes. This makes accounts receivable management, invoice tracking, and payments more demanding.

The accounting and finance departments' main activities are similar, but their approach to collections differs. They use different systems (ERP and CRM) and have unique priorities and problems with customer relationships.

Besides, most AR departments find that flowcharts illustrate a non-linear process, adding complexity to its operation.

An accounts receivable flowchart documents and summarizes each step throughout the collection process. It clarifies to employees and managers what tasks are needed at each stage to ensure the company gets timely payments.

When you see an accounts receivable flowchart, it's clear that even a single invoice can follow a non-linear path and involve many people and organizations. The process grows in complexity as more suppliers are added to the process. Directions can be more easily sorted out and managed using this tool.

Accounts Receivable Flowcharts and Automation

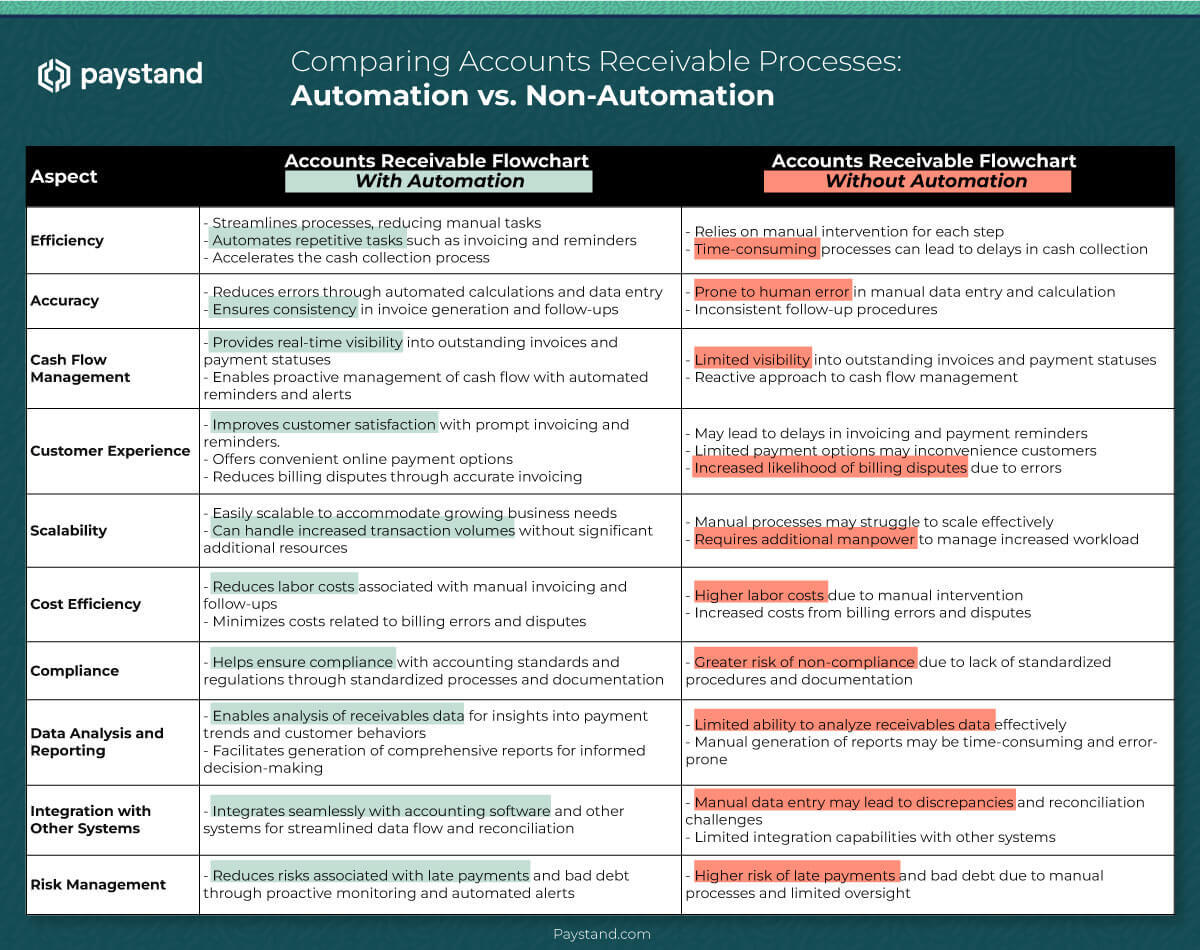

Technology's strength is automating repetitive, manual processes, which is abundant in AR departments. Many solutions automate collections but must be integrated to avoid data re-entry within larger systems.

Automation takes on repetitive tasks to computers, which are more efficient and less error-prone than humans. Besides, it lets your team focus on more challenging and meaningful work, improving morale and retention. This helps reduce operational costs, gain efficiency, scale to growth, improve cash flow, and reduce AR turnover days.

How Accounts Receivable Flowcharts Improve Payments

Some improvements found through many accounts receivable flowcharts include more efficient invoice payment methods. Consider the following areas:

Make It Easy for Customers to Pay

The faster you collect customer payments, the shorter your DSO will be. This will improve your cash flow. One way to do this is by offering multiple payment options to ease payment submission.

Paystand lets you incorporate a "Pay Now" button into electronic invoices and payment reminder emails. When customers click, they're taken to a screen that lets them pay by credit card, electronic funds transfer, or ACH. This short process means customers can pay as soon as they see the invoice. There's no need to open an envelope, manually process the invoice, cut a paper check, and mail it, which takes time and labor.

Encourage Early Payments

Managing flexible and varied payment options is easy with AR automation software. Most organizations charge late fees for payments made outside 30 or 60 days, but you can also incentivize early payments. For example, you can discount current or future invoices for early payments.

Keep Communication Lines Open

Automation software provides a channel for your staff or AR outsourcing to communicate with customers with payment problems. Easy and transparent communications can ease a potentially tricky process if they need more time or have a dispute.

Streamline Reconciliation

Keeping track of this can be challenging once invoices, disputes, or other roadblocks are processed. Reconciling payments as they come can be a heavily manual process. By automating it, reconciling can be immediate and real-time for better decision-making.

Improve Audit Trail

Having all the details for a potential audit can be nerve-racking for accounting professionals. The right solution can automatically generate an audit trail without painstaking customer notes. It can record all customer interactions, helping you resolve and document disputes. You'll also have an accurate record of credit terms, agreements, payment deadlines, or fee structures.

The Paystand Solution

Paystand can automate your AR process, simplifying your flowchart and eliminating manual tasks. Free up hours for higher-level tasks, cut human errors, reduce late payments, and drop fees with Paystand's bank-to-bank network. It also accepts legacy payments such as ACH, credit/debit, wires, EFT transfers, virtual cards, and checks.

Here are some ways Paystand can streamline your accounts receivable process flowchart:

- Comprehensive Dashboard. This feature lets you quickly see collected and pending receivables using standard or custom periods. It's easy to group your receivables into status and type categories to view the clearest picture of all your receivables in one place.

- Smart Receivables. Create and edit digital receivables to gather critical customer data within the record. This allows your staff to track and securely store data about the item and tie it directly to its standard or custom collection plan. You can manage related workflows, review payment events, or communicate with necessary parties.

- Payment Links. Simplify customer payments with easy-to-use links in electronic invoices or email follow-up communications. Immediate functionality lets customers pay upcoming bills and choose their favorite payment options.

- Recurring Subscriptions or Invoices. Many businesses operate subscription-based companies, accept payment plans, or deal with repeat invoices. Paystand lets you schedule invoices in advance, create automatic payment options, and build customized payment schedules for multiple invoices.

- Payment Portal. Fully customize the payment experience for your customers. White-label your checkout experience, invoices, and other customer-facing interactions for brand consistency. Payment rails can be turned on or off based on your company's specific needs.

- Real-Time Visibility. After a payment, Paystand immediately records it against the proper invoices within your ERP system.

- Automatic Reconciliation. The system books payments to your invoices, statements, and sales orders and immediately updates your records. You'll receive automatic transfer reports with deposit details and know immediately which invoices and sales orders are affected by the deposit.

- Flexible Integrations. With a rich, flexible, and restful API, Paystand allows easy integration of this payment component into your unique platform. Whether you're a high-growth startup or a major corporate enterprise, Paystand can support your payment needs. Connecting the platform to your specific ERP, eCommerce, mail, CRM, and accounting systems is easy.

- Zero-Fee Payment Rail. With Paystand, you can accept legacy payment options such as ACH, debit, or credit cards or use the zero-fee Paystand Bank Network. This network provides access to automated payment settlements, real-time verification, fund transfers, and payment tracking. As a result, companies can see if a customer has sufficient funds to pay an invoice.

- Least-Cost-Routing. This Paystand technology helps customers reduce payment processing costs by encouraging them to use the lower-cost payment method.

- Payer Convenience Fees. While Paystand negotiates wholesale rates on customers' behalf, it also determines who pays transaction fees for other payment options. Customers can choose to:

- Absorb the entire cost

- Share the cost with their customer

- Pass the cost on entirely to the customer

- Set a minimum invoice amount threshold that makes the decision

- Virtual Terminals. It's easy to allow your staff to pay on your customers' behalf through Paystand. You can enter payment information from existing forms, contracts, or previous payments using the dashboard feature.

- Fund-on-File Tokenization. This secure method gives you control to authorize, charge, and re-use your customers' payment methods. You can do all this without accessing their private information directly. Paystand is a PCI Level 1-certified payment processor and adheres to the latest security and fraud prevention standards.

- Payment Assurety. Finally, every payment made using Paystand's network is recorded on the Assurety blockchain. This notarized record trail is secure, verified, and digitally auditable, as nobody can alter these records. This assures transactions are valid and free of tampering.

With an accounts receivable flowchart, you can visualize how your existing processes work. Now, finding ready-for-automation spots and process improvement becomes much easier with solutions like Paystand. Contact us today for more information on streamlining your accounts receivable process flowchart.