Streamline Your Sage Intacct Bank Reconciliation Process with Automation

Table of Contents

- How do you Account for Bank Reconciliation?

- What are the Steps in the Bank Reconciliation Process?

- A Step-by-Step Guide to Reconciliation in Sage Intacct

- Improving Reconciliation

Key Takeaways

- Payment reconciliation is vital for accurate accounting, fraud detection, and informed decision-making.

- Manual reconciliation is a significant challenge as it is time-consuming, with accounting departments spending up to 432 hours annually.

- Bank reconciliation involves gathering materials, comparing bank statements with accounting records, investigating discrepancies, making adjustments, completing a reconciliation worksheet, and filing it for future reference.

- Automated reconciliation provides enhanced fraud detection, time and cost savings, accelerated collections and financial closing, scalability for growth, and improved clarity and transparency.

Payment reconciliation is a crucial step in the accounting process. It ensures company accounts are up to date and helps uncover fraud, errors, and outstanding balances. Reconciliation gives you a comprehensive view of your company’s financial health so you can forecast your cash flow and make insightful, strategic financial decisions.

Unfortunately, bank account reconciliation as a manual process is time-consuming, eating up time that could be better spent on more high-level projects. Accounting departments spend 36 hours manually reconciling payments monthly, up to 432 hours, or 18 days yearly.

Keep reading if you’d like to free up your staff’s time for more strategic tasks. We’ll unravel how reconciliation can be an efficient process with Paystand’s Sage Intacct integration, combining one of the most popular ERP systems and the power of automation.

How do you Account for Bank Reconciliation?

Bank reconciliation compares your bank statement to your accounting records to ensure they match. This process is essential for several reasons:

- It helps you catch any errors in your accounting records.

- It enables you to identify any unauthorized transactions.

- It allows you to ensure you have a complete record of your financial transactions.

What are the Steps in the Bank Reconciliation Process?

- Gather your materials. You will need your bank statement, accounting records, and a reconciliation worksheet.

- Compare your bank statement to your accounting records. Go through each transaction on your bank statement and compare it to the corresponding transaction in your accounting records. Make sure that the amounts and dates match.

- Identify any discrepancies. If you find any discrepancies, you will need to investigate them. This may involve contacting your bank or reviewing your accounting records more closely.

- Make any necessary adjustments. Once you have investigated any discrepancies, you must make any necessary adjustments to your accounting records. This may involve adding or removing transactions or correcting errors.

- Complete your reconciliation worksheet. Once you have made all of the necessary adjustments, you will need to complete your reconciliation worksheet. This worksheet should show the beginning balance on your bank statement, the ending balance on your bank statement, the beginning balance in your accounting records, the ending balance in your accounting records, and any adjustments you made.

- Review your reconciliation worksheet. Once you have completed it, you should review it carefully to ensure its accuracy.

- File your reconciliation worksheet. Once you have reviewed it, you should file it with your other accounting records. This will help you keep track of your bank reconciliations and make it easier to identify any errors in the future.

Paystand’s Sage Intacct integration delivers an efficient reconciliation process with automated cash application and deposit reports. Everything integrates into your Sage Intacct Dashboard, giving you a real-time view of your finances. You can find this solution in the Sage Intacct Marketplace.

A Step-by-Step Guide to Reconciliation in Sage Intacct

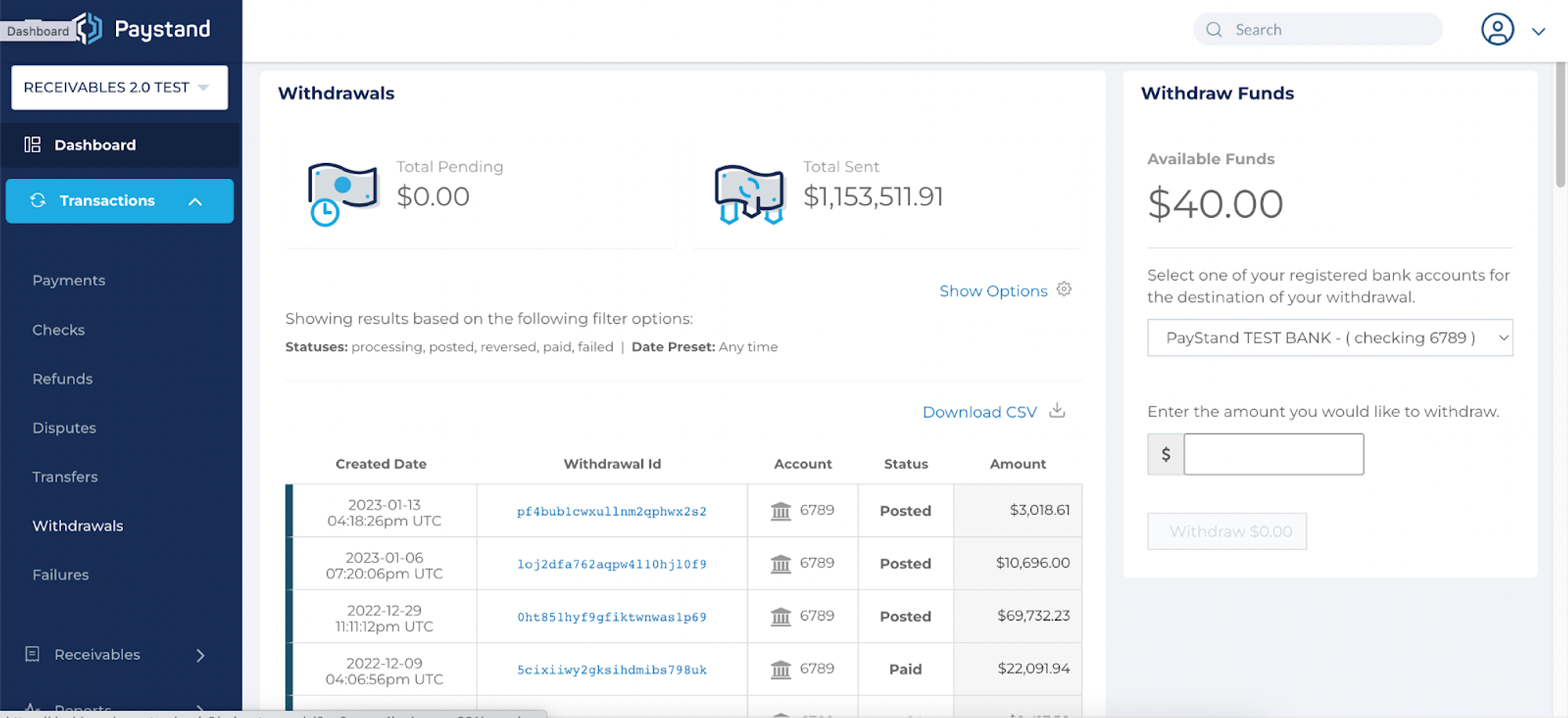

1. Empty your available funds' balance by going to Transactions → Withdrawals in your Paystand Dashboard.

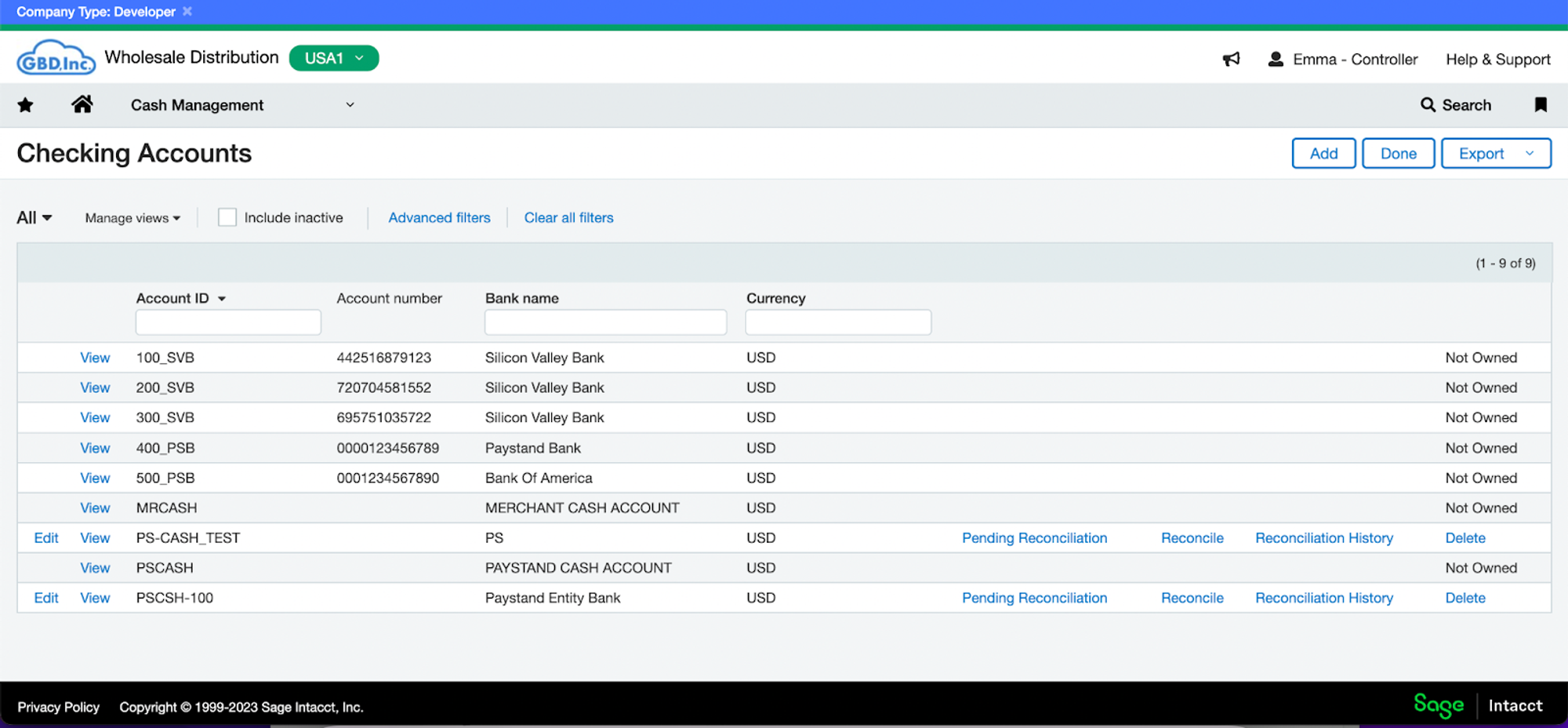

2. Select the subsidiary connected to your Paystand Dashboard from your Sage Intacct Dashboard. Select Cash Navigation → Checking. A table will open up. Select the checking account linked to your Dashboard and click Reconcile.

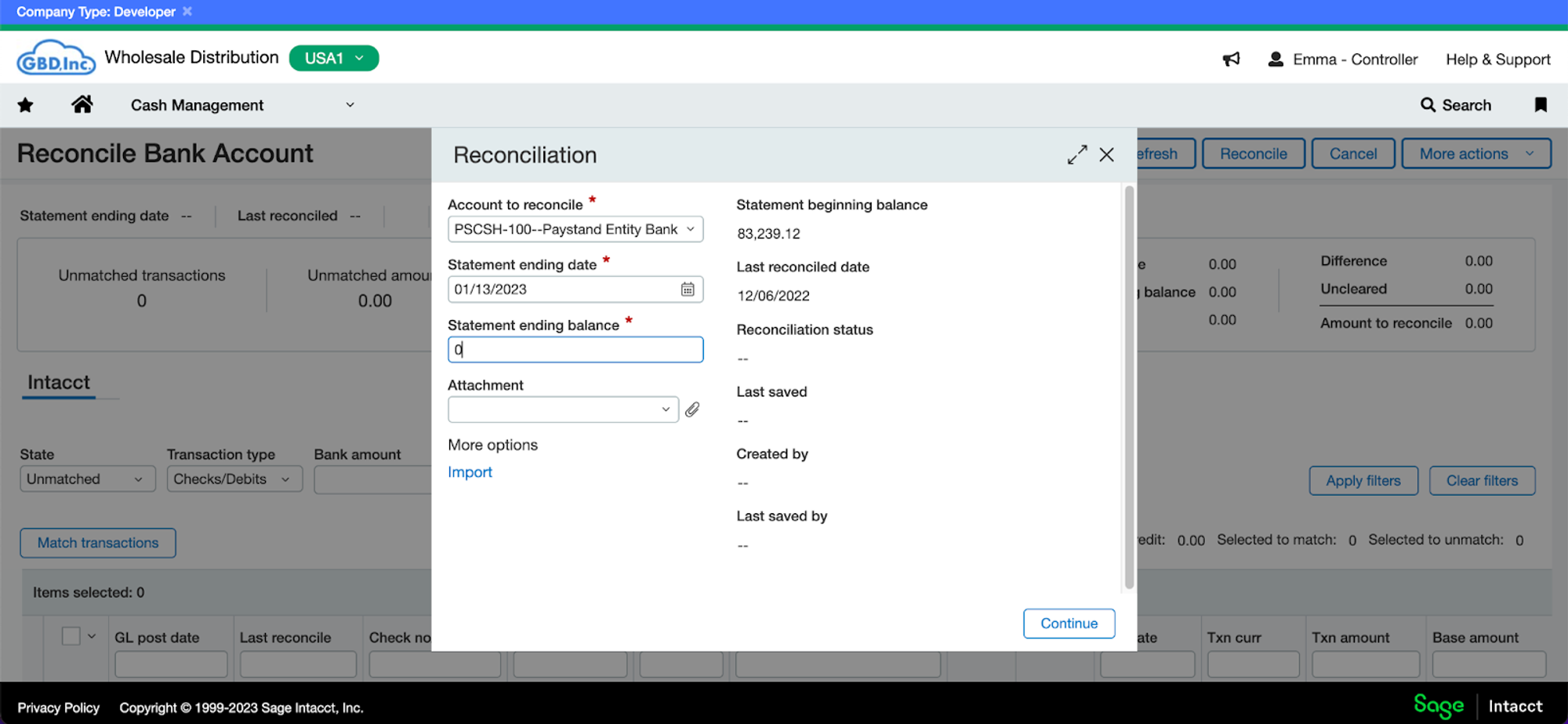

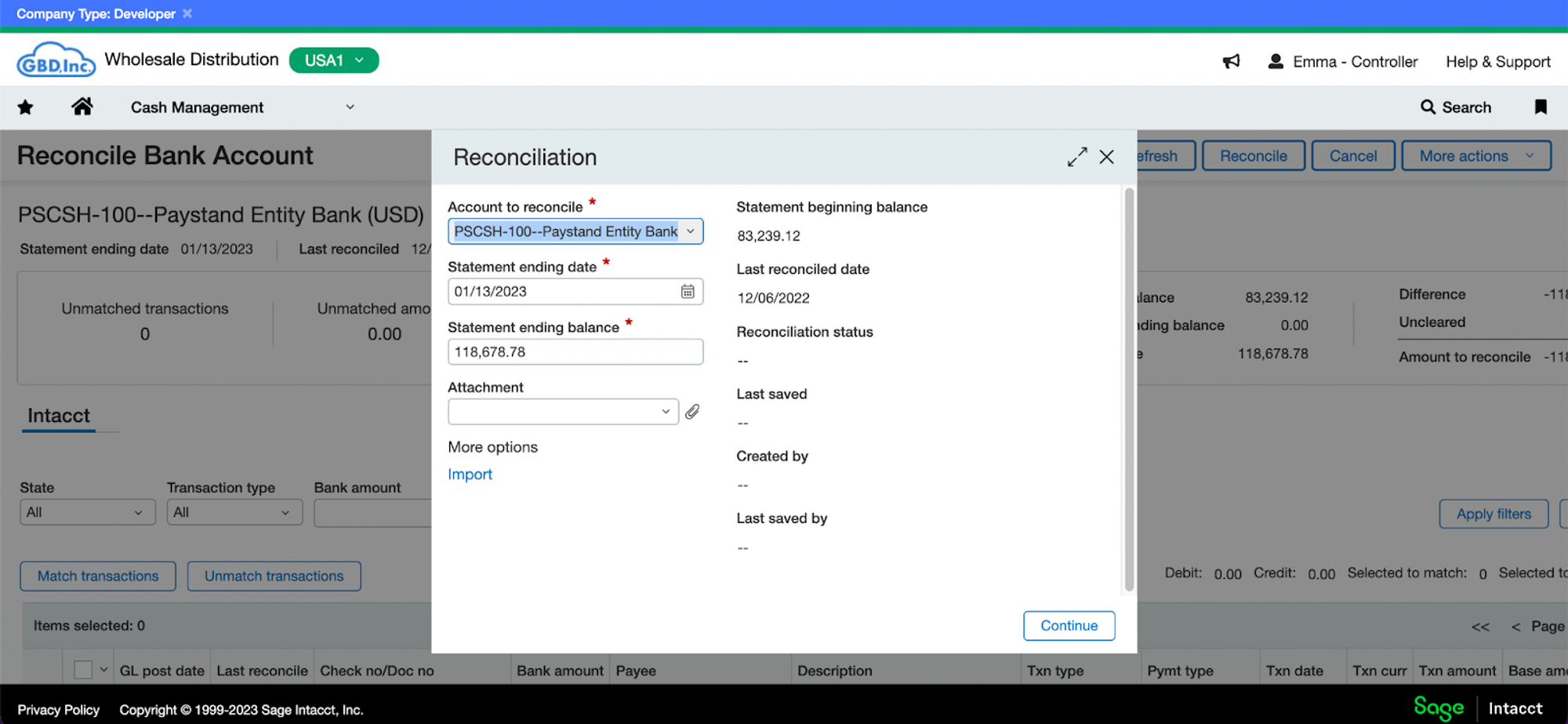

3. Enter your bank statement’s ending date and any number on the Statement Ending Balance field, and click Continue.

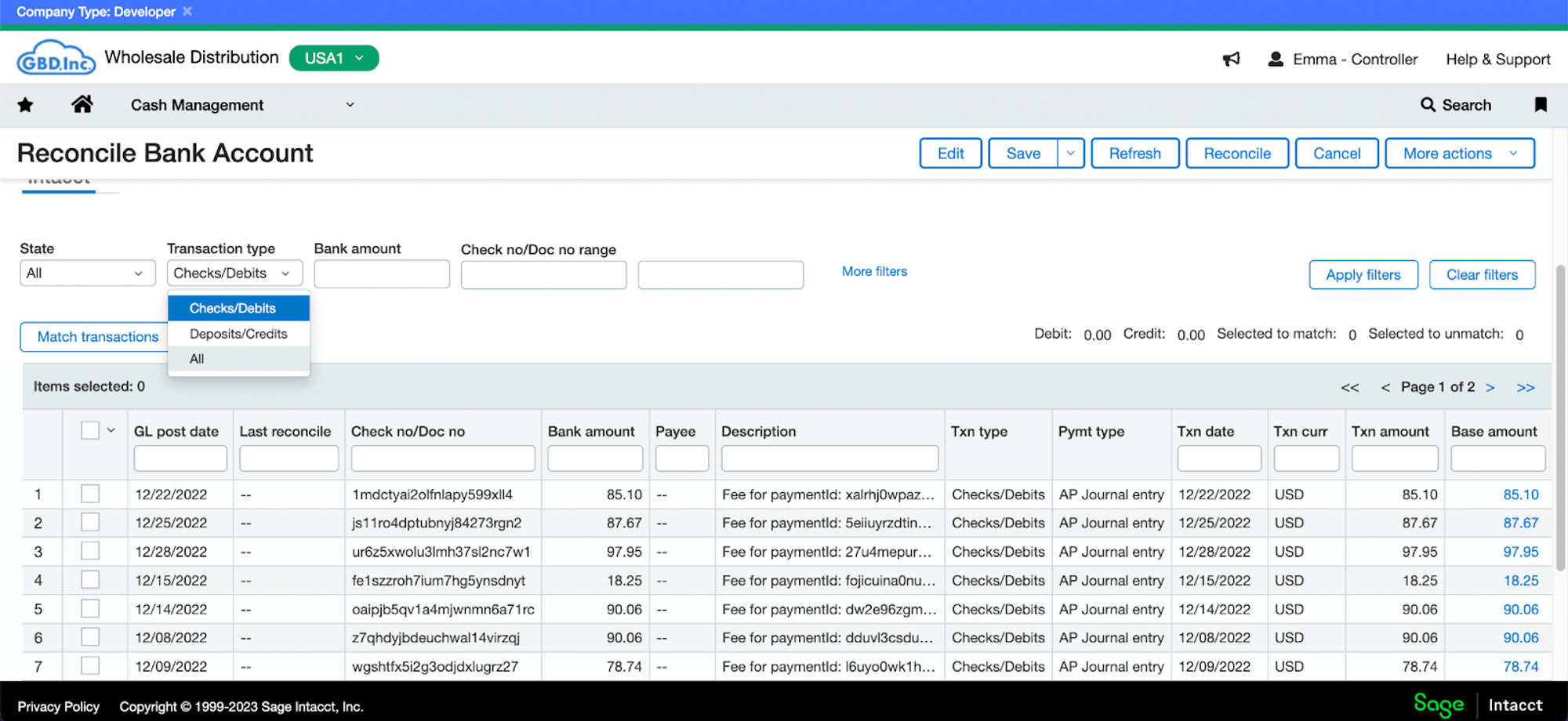

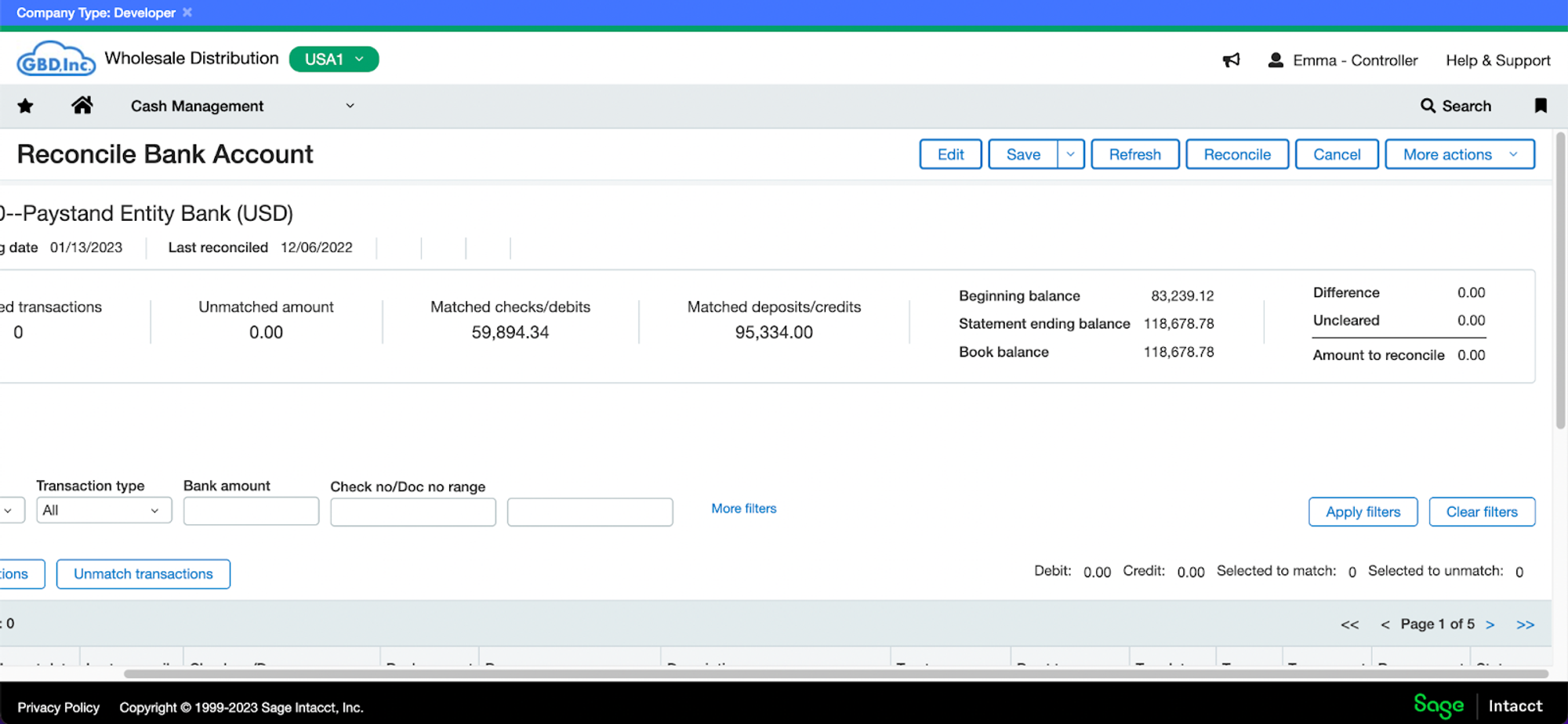

4. Scroll to the bottom of the page, where you’ll find a table with a list of filters. On the right side of the screen, select All and Apply Filters.

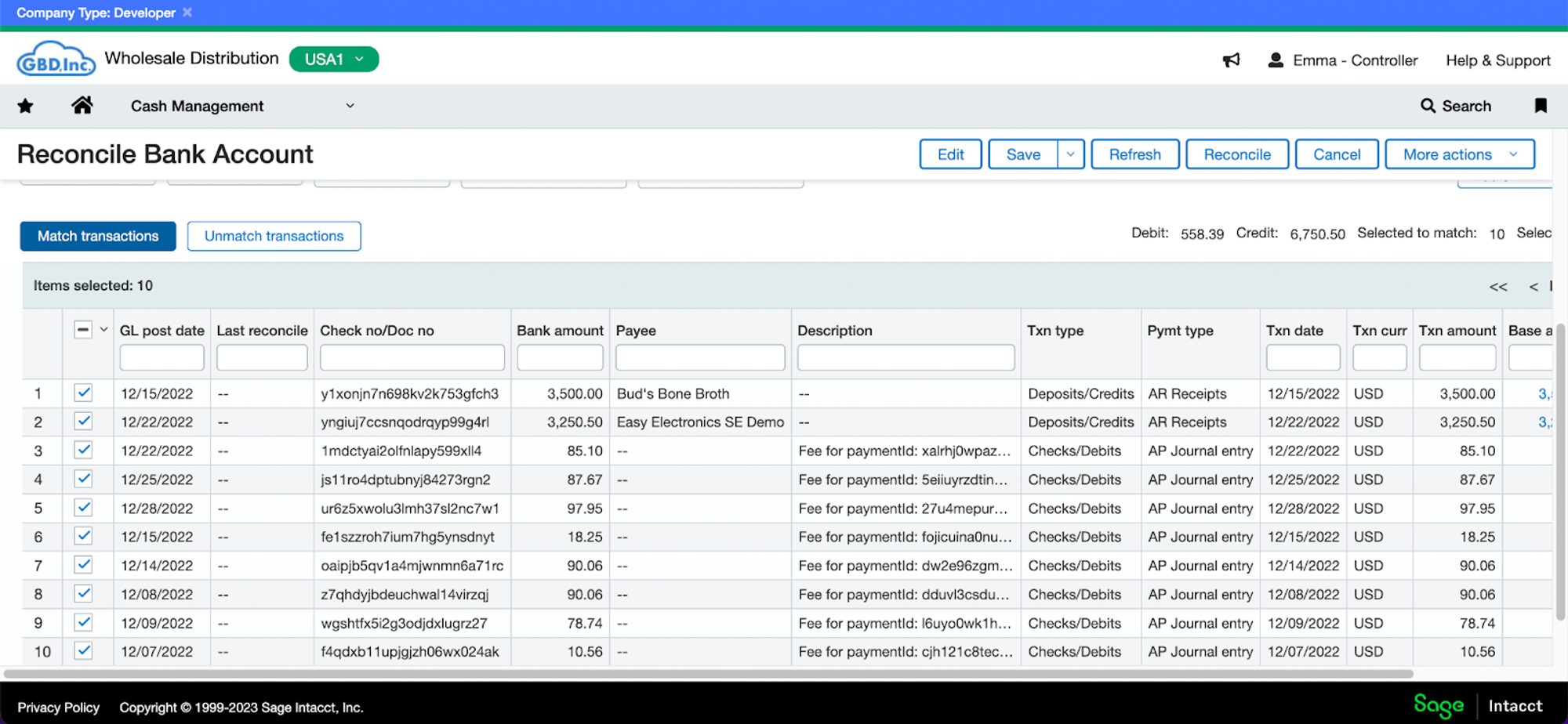

5. Select all items in the table and click Match Transactions.

6. Copy and paste the Book Balance amount into the Statement Ending Balance field at the top of the page and click Continue.

7. The amount to reconcile should now equal 0. Click Reconcile at the top of the page.

Improving Reconciliation

With digitized and automated reconciliation, you can halve your closing time. This frees up your AR resources for more strategic tasks, contributing to business growth and expansion.

Paystand’s Sage Intacct integration enables effortless reconciliation while delivering the following benefits:

- Enhanced fraud detection. The software can quickly flag mismatched records, allowing your finance team to identify and address fraud more effectively.

- Significant time and cost savings. Automation eliminates manual tasks that consume your finance team's time. You can focus on strategic planning while minimizing labor costs associated with routine tasks.

- Accelerated collections and financial closing. Automation eradicates reconciliation errors and manual tasks, reducing the month-end close time from weeks to days.

- Scalability for growth. Automation allows you to efficiently scale your payment reconciliation processes as your company expands and incorporates additional revenue streams and payment methods.

- Improved clarity and transparency. Automated payment reconciliation eliminates the guesswork in financial forecasting. You'll gain real-time visibility through customizable dashboards, graphs, reports, and charts.

Click here to learn more about how our Sage Intacct integration makes AR so easy it almost feels like cheating on your accounting chores!