SMART CHECKOUT

-

Solutions

Solutions

Unlock radically better economics by incentivizing profitable outcomes through fee-less and automated AR processes.

SMART CHECKOUT

SMART DATA

-

Integrations

Integrations

Paystand integrates with major ERP and order management systems to provide robust payment functionality directly within your System of Record.

Integrations

NetSuite Best Practices Kit

Learn the key elements for automating payments within NetSuite to streamline your payments process.

-

Resources

Resources

Most AR professionals are searching for new ways to reduce costs, improve cash flow, and optimize their processes. Paystand has curated content to help AR professionals in their quest.

CONTENT BY TYPE

LEARNING RESOURCES

The Future of FinanceUncover the trends, tools, and strategies you need to stay ahead of the curve.

-

Company

Company

Paystand is revolutionizing B2B payments with a modern infrastructure built as a SaaS on the blockchain, enabling faster, cheaper, and more secure business transactions.

Our mission is to reboot commercial finance by creating an open financial system.

Learn About Our MissionPARTNERS

Join Paystand's partnership program today.

PRESS

Read about Paystand business updates and technology announcements.

CAREERS

Join our fast-growing team of disruptors and visionaries.

CONTACT

Talk to the Paystand team today.

sales@paystand.com

(800) 708-6413Our Offices

HQ | SANTA CRUZ

101 Church Street

101 Church Street

2nd Floor

Santa Cruz, CA 95060Guadalajara

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

Av. de las Américas 1254, Country Club, 44610 Guadalajara, Jalisco México

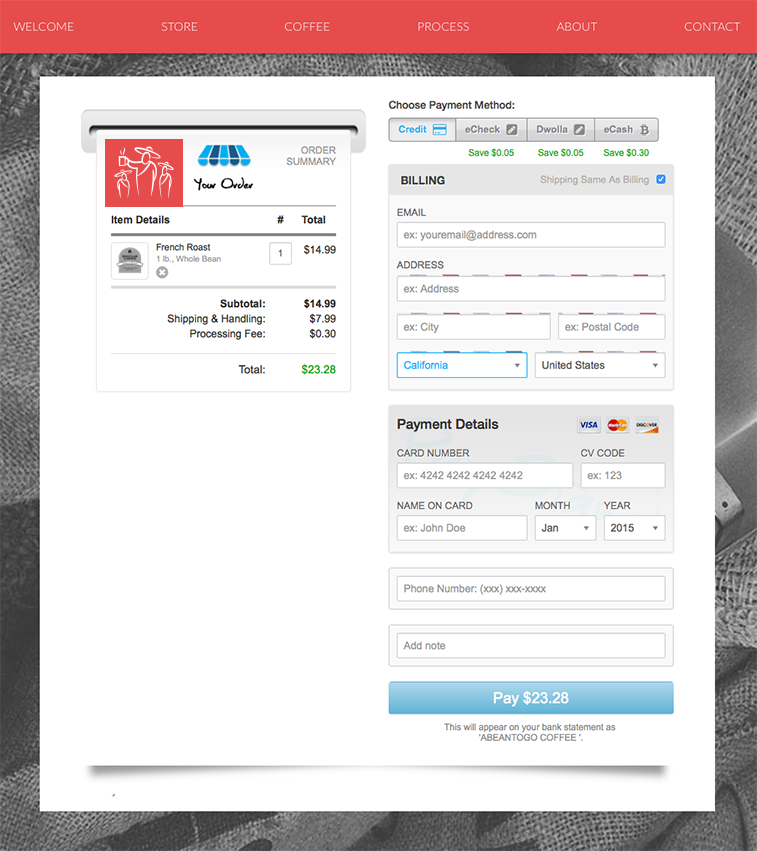

Accept Credit or Debit Card Payments on Web and Mobile

We take a different approach to Credit and Debit card payments. With our Payments-as-a-Service model, you benefit from low, wholesale transaction rates that save you more as you grow.

One low flat rate

One low flat rate

With PayStand, your customers can use their Visa, MasterCard, and American Express, Discover, Diners Club or JCB cards, regardless of domestic/international or card present/not-present. We don't mark up our wholesale credit/debit card rates. By utilizing PayStand, you benefit from low rates that are normally reserved for large corporations with high transaction volumes.

Pass on transaction fees

Pass on transaction fees

Credit/Debit card fees are unavoidable, but you can increase your profit margins by passing those fees on to your customers. By asking your customers to absorb the fees and giving them discounted payment options at checkout, you can lower your transaction costs to see the difference in your bottom line.

Include Zero-percent Options

Include Zero-percent Options

PayStand gives you the ability to turn on 0% payment rails in your online checkout, allowing your customers to choose the best option for them and lowering your costs in the meantime. Turn on the eCheck rail to accept a direct bank account debit or even offer discounts for alternative payment methods that calculate your customer's savings within the checkout window.

Keep your customers on your site with PayStand's inline checkout.

No redirects or 3rd party logins to distract your customer from completing the sale.

Customize your checkout with your logo and preferred payment methods.

Set automatic recurring payments

Set automatic recurring payments

Enable monthly or annual payment options in your checkout so your customers can pay you over time. Recurring payments are a great way to lower the barrier to entry to your products and get paid on time, automatically.

Keep your branding and data

Keep your branding and data

You've worked hard to build a brand and a trust relationship with your customers. As your payment provider, we let your branding take over so that your customer can quickly and confidently complete their purchase. Customize your checkout with your logo and keep your customers on your site throughout the payment process.

Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle. Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue.